When considering a mortgage loan, one of the most crucial aspects is understanding your repayment structure and the interest you will be paying over time. A mortgage loan is a significant financial commitment, and knowing exactly how much you will pay each month can help you manage your finances effectively. This is where a mortgage loan calculator comes in handy. With just a few clicks, you can calculate your mortgage repayments and interest, allowing you to make informed decisions.

Why Understanding Mortgage Loan Repayments is Essential?

Taking out a mortgage loan is often one of the largest financial decisions that a person will make. The repayment process involves paying back the loan amount plus interest over an agreed period. Without a clear understanding of how these repayments are structured, you may find yourself struggling to keep up with payments, leading to financial strain. Hence, using a mortgage loan calculator can give you a clear picture of your financial obligations.

Functionality of a Mortgage Loan Calculator

A mortgage loan calculator is a tool designed to help borrowers calculate the monthly repayments on their mortgage. It takes into account the loan amount, interest rate, and the tenure of the loan to provide an accurate estimate of what your monthly instalments will look like. By providing these details, you can get a clear view of how much you will need to pay each month, and how much of that payment will go towards the principal and interest.

Key Inputs for the Mortgage Loan Calculator:

• Loan Amount: The total amount borrowed.

• Interest Rate: The rate at which interest is charged on the loan.

• Loan Tenure: The duration over which the loan is repaid.

These three inputs are crucial in determining your monthly repayment amount. The calculator also allows you to adjust these variables to see how changes in interest rates or loan tenure can affect your repayments.

Calculating Your Mortgage Repayments

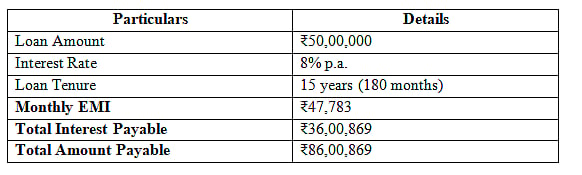

Let us take an example. Suppose you have taken a mortgage loan of ₹50 lakh at an interest rate of 8% per annum for a tenure of 15 years. Using the mortgage loan calculator, you can easily compute your monthly EMI (Equated Monthly Instalment).

Here is a breakdown:

This table shows that your monthly EMI will be approximately ₹47,783. Over the course of 15 years, you will end up paying ₹36,00,869 as interest, making the total repayment amount ₹86,00,869.

Bajaj Finserv Mortgage Loan

When it comes to choosing the right lender, Bajaj Finance offers a variety of options tailored to meet the needs of different borrowers. Their Loan Against Property is a flexible mortgage option that allows you to borrow funds against the value of your property. This product comes with competitive interest rates, flexible repayment options, and high loan amounts.

Moreover, the Bajaj Finserv App allows you to manage your mortgage loan conveniently. With this app, you can easily check your loan balance, make payments, and even use the built-in mortgage loan calculator to plan your finances better.

How the Bajaj Finserv Mortgage Loan Calculator Works?

Using the mortgage loan calculator provided by Bajaj Finserv is straightforward. Simply enter your loan amount, select the interest rate, and choose your preferred loan tenure. The calculator will then instantly provide you with your monthly EMI and the total interest payable.

Steps to Use the Bajaj Finserv Mortgage Loan Calculator

1. Enter Loan Amount: Specify the amount that you wish to borrow.

2. Set Interest Rate: Choose the interest rate applicable to your loan.

3. Select Loan Tenure: Decide on the repayment period that suits your financial planning.

4. Calculate: The calculator will display the monthly EMI and total interest.

This tool is particularly useful for borrowers who want to explore different scenarios before finalising their mortgage. It empowers you to make the best decision by giving you a comprehensive understanding of how your mortgage loan will affect your finances.

Importance of Using a Mortgage Loan Calculator

Using a mortgage loan calculator is essential for anyone planning to take out a mortgage. It helps you plan your finances better by providing a clear estimate of your monthly obligations. This way, you can ensure that the mortgage loan fits within your budget and that you are prepared for the financial commitment ahead.

In conclusion, a mortgage loan calculator is an invaluable tool for anyone looking to take out a mortgage loan. It provides clarity and precision, helping you understand exactly what your financial commitments will be. Whether you are planning to buy a home or refinance an existing mortgage, using this tool will help you make informed decisions. And with Bajaj Finserv Loan Against Property and Bajaj Finserv App, managing your mortgage loan is always easy.