Delhi, October 7th 2021: With India celebrating 75 years of Independence, the Government of India has launched “Azadi ka Amrit Mahotsav” for various outreach activities on financial services, with focal theme of ‘Janta Se Jodna’.

In line with the above Government’s initiative, Punjab National Bank, as the country’s second largest Public Sector Bank, has launched a “6S Campaign” encapsulating different schemes such as – Swabhiman, Samruddhi, Sampark and Shikhar, Sankalp and Swagat. The objective is to drive special awareness campaign for development of financial services in the country and to accelerate credit growth, improve penetration of social security schemes and drive digital banking push.

Through Swabhimaan, the Bank aims to aggressively push the financial inclusion agenda by deepening penetration of the three Jan Suraksha or Social Security Schemes pertaining to the insurance and pension sector namely, Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Yojana, and Atal Pension Yojana. PNB plans to leverage its extensive physical footprint in rural areas, through branches and banking correspondents.

Under Samruddhi scheme, Bank aims to drive credit outreach for the agricultural sector which is the cornerstone of Indian economy. The scheme will cover all agricultural credit products like KCC, Gold Loans, Investment Credit, etc., and the Bank aims to leverage multiple strategic partnerships made in this sector to drive impetus.

Under Shikhar, Sankalp and Swagat schemes, the Bank has devised special rates of interest to drive credit offtake in retail and MSME sector. In addition, focussed products and customer segments have also been identified for targeted outreach in line with the Bank’s broader strategic agenda. Specifically for MSME sector, the Bank has formed specialized teams in select districts for credit delivery. Further, the Bank has deepened concessions for select products in line with “One district one product” policy to ensure access to affordable credit for MSMEs in the country.

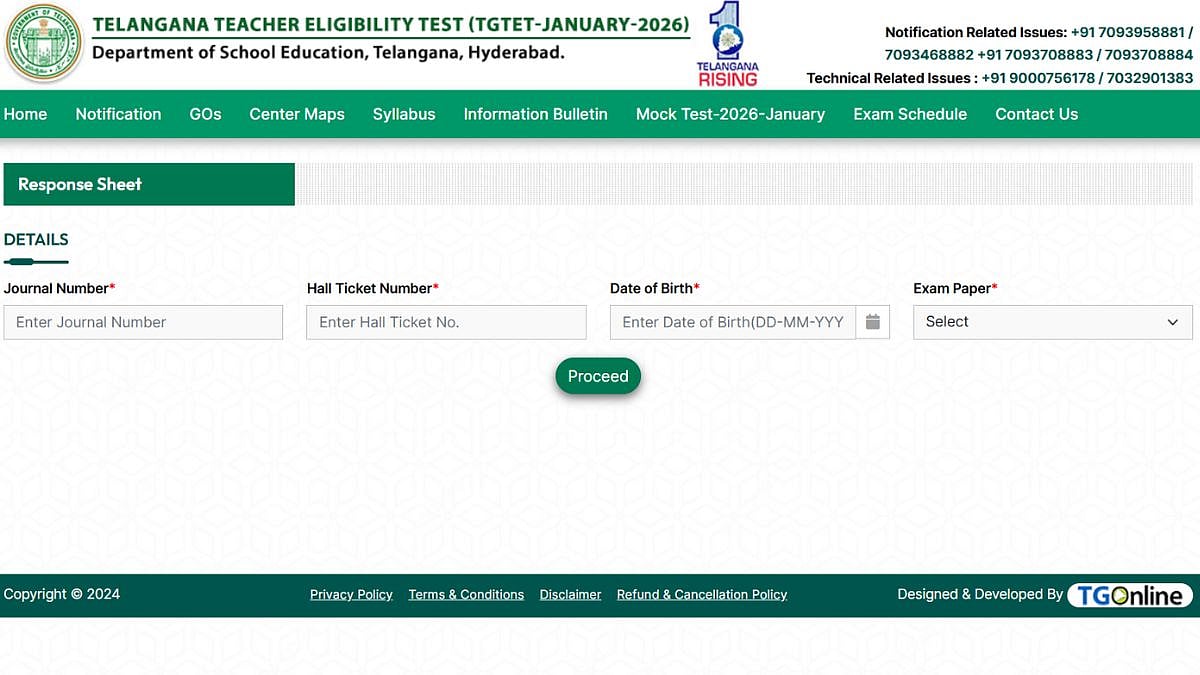

Within the ambit of Digital Outreach and Service Delivery, Bank would run a Sampark camapign, aimed at driving penetration of its flagship mobile application, PNB One. Bank will also focus on improving adoption and activation of debit cards as well as improving overall experience of customers at different banking touchpoints such as branches, ATMs, etc.