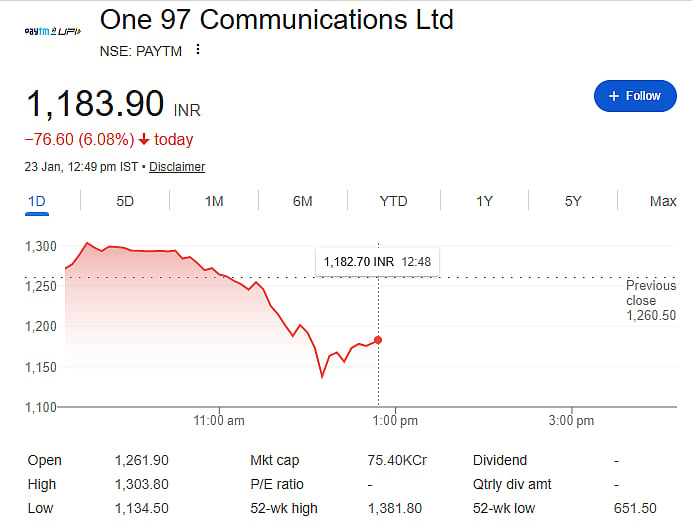

Mumbai: Shares of One 97 Communications Ltd, the parent company of Paytm, witnessed a sharp decline in Friday’s trading session. The stock fell more than 6 percent, marking a weak day for the digital payments major. Paytm shares were trading around Rs 1,183.90, down Rs 76.60 or 6.08 percent, reflecting strong selling pressure through the day.

The stock opened at Rs 1,261.90, but failed to sustain early levels. As the session progressed, selling intensified and dragged the price lower. Paytm touched an intraday high of Rs 1,303.80 before sliding to a day’s low of Rs 1,134.50.

Heavy intraday volatility

Paytm’s share price movement showed high volatility. After opening near the previous close of Rs 1,260.50, the stock initially moved higher but quickly reversed direction. By early afternoon, it was trading near Rs 1,182, close to the day’s lows, indicating weak buying support at lower levels.

Such sharp intraday swings often signal nervousness among investors, especially after a strong or extended rally in recent weeks.

Stock still off 52-week high

Despite recent gains earlier this year, Paytm shares remain well below their 52-week high of Rs 1,381.80. The sharp fall has widened the gap between current prices and peak levels, raising concerns about short-term momentum. However, the stock is still comfortably above its 52-week low of Rs 651.50, suggesting that long-term recovery from earlier lows remains intact.

Market capitalisation and valuation

At current levels, Paytm’s market capitalisation stands at around Rs 75,400 crore. The company does not currently report a price-to-earnings (P/E) ratio, as it continues to focus on improving profitability and strengthening its core business segments such as payments, lending distribution, and merchant services.

What is weighing on the stock?

The decline appears to be driven by profit booking after recent gains, along with broader market weakness. Technology and fintech stocks have seen pressure amid cautious investor sentiment, rising volatility, and concerns around valuations. The lack of fresh positive triggers also kept buyers on the sidelines.

Near-term outlook

In the near term, Paytm shares may remain volatile as investors closely track business performance, regulatory developments, and broader market trends. Sustained recovery will likely depend on clearer earnings visibility and continued improvement in operating metrics.

Disclaimer: This article is for information purposes only and does not constitute investment advice. Stock market investments are subject to risk. Readers should consult a qualified financial advisor before making any investment decisions.