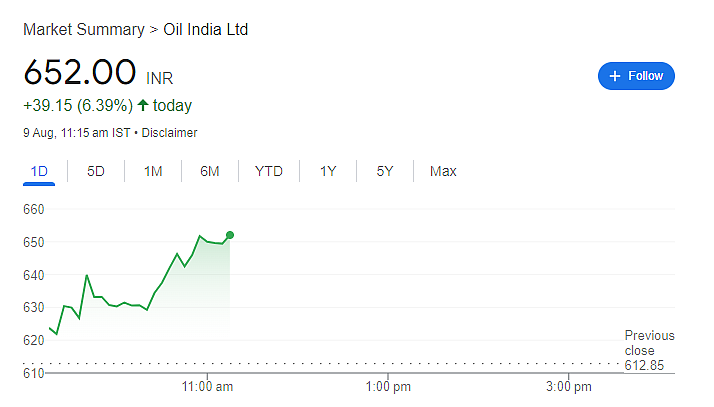

The state-run oil exploration company Oil India's share price shot up by over 6.5 per cent on the National Stock Exchange. The stock opened at Rs 619.00 per share; the price of the stock has reached a day high of Rs 654.00 per share on the stock exchanges.

Oil India has recorded a 52-week high level of Rs 654.00 per share, which is also the all-time high price of the stock. The stock was trading at Rs 641.90 per share at 01.15 am on the National Stock Exchange.

Oil India Q1 FY25

Q1 FY25 net profit

For the April–June quarter, government-run PSU Oil India Ltd. reported a 27.7 per cent decline in its consolidated net profit. The company released its results on Thursday, after market hours.

For the quarter that ended in June, the company reported a profit of Rs 1,466.8 crore, down from Rs 2,028.8 crore for the adjecent quarter that ended in March.

Revenue Q1 FY25

Oil India, which primarily manages exploration and production assets in the northeastern region of the nation, reported that a 26 per cent increase in quarterly revenue to Rs 5,840 crore was offset by a nearly 40 per ecnt increase in total expenses to Rs 4,026 crore due to an increase in excise duty costs that more than quadrupled.

EBITDA Q1 FY25

EBITDA, or earnings before interest, tax, depreciation, and amortisation, increased by 5.6 per cent to Rs 2,466.1 crore in the most recent quarter, while the EBITDA margin increased by 400 basis points to 46.3 per cent in March from 42.3 per cent.

Windall tax

India tripled the windfall tax on petroleum crude during the quarter. Windfall taxes are higher taxes imposed on particular industries when they experience a sudden increase in profits.