The Union Minister for Finance has started her historic budget for the fiscal year, 2025-26.

The FM laid emphasis on the much-discussed middle class of the country.

She added convenience of the taxpayer is a top priority.

In a move in the direction bring some relief to taxpayers, the FM said that the new tax bill will only be introduced next week.

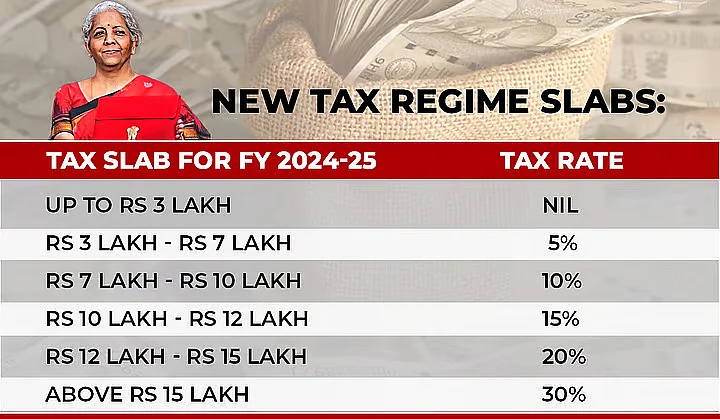

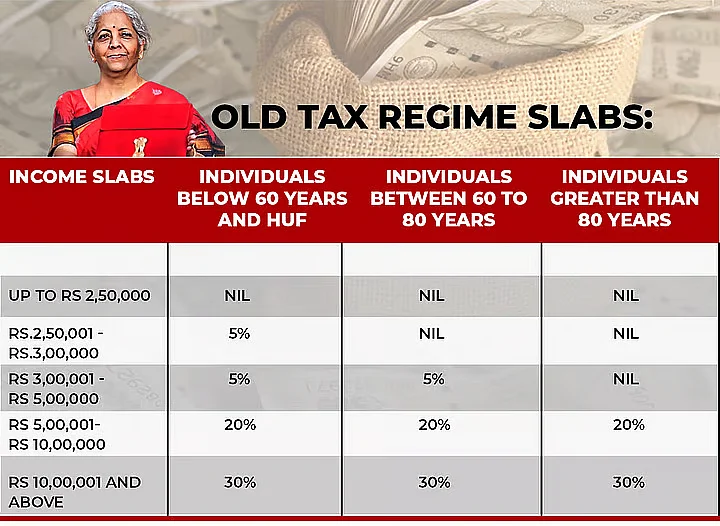

India currently has two tax regimes, the old and the new tax regimes.

This comes after anticipations of major overhaul of the taxation regime.

Currently, citizens in the country can choose between two income tax regimes. There are the Old and the New Tax Regime.

The existing tax regimes as are follows, as displayed in the image below.

The Union minister also said that the new income tax bill will like the new BNS or Bharatiya Nyay Sahita or BNS. It would be an embodiment of Nyay or justice or fair.

The FM further added that the new taxation system would be fair and simple for taxpayers of simple for taxpayers.

The threshold will be increased on TDS to increase savings.

The focus will also be on senior citizens, and to increase compliance in paying taxes and ease of doing of business