Key Highlights

- M&B Engineering’s Rs 650-crore IPO opens on July 30 & closes on August 1.

- Funds to be used for buying machines, paying debt, and business needs.

- Listing expected on August 6; price band fixed at Rs 366–385.

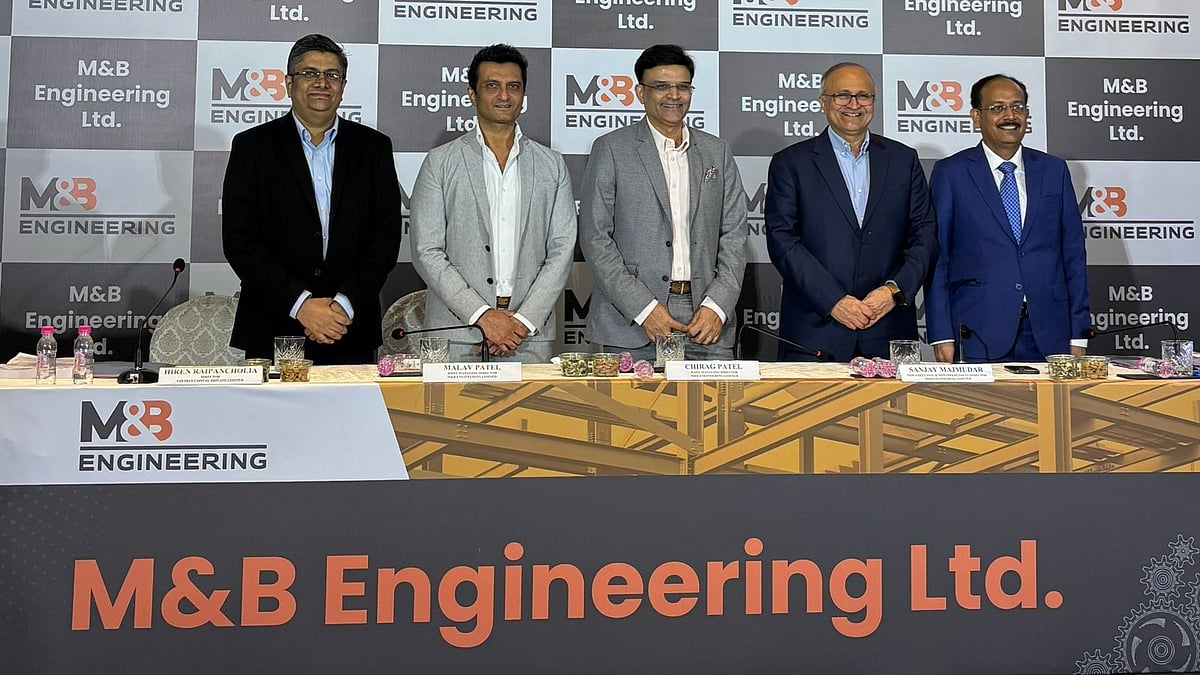

Mumbai: M&B Engineering Ltd has announced that its Rs 650-crore Initial Public Offering (IPO) will open for public subscription on July 30 and will close on August 1. The price band for the issue has been set at Rs 366 to Rs 385 per share.

At the upper price limit of Rs 385, the Gujarat-based company’s market value is estimated to be around Rs 2,200 crore.

Issue Structure and Use of Funds

The IPO is a mix of two parts:

- A fresh issue of equity shares worth Rs 275 crore

- An offer-for-sale (OFS) of shares worth Rs 375 crore by the company’s promoters

The money raised from the fresh issue will be used for:

- Buying equipment and machinery for manufacturing

- Paying off company debt

- Meeting working capital needs

- General corporate expenses

About the Company

M&B Engineering is one of India’s top companies in the Pre-Engineered Buildings (PEB) and Self-Supported Roofing segment. It has a production capacity of:

- 103,800 metric tonnes per year for PEB

- 1,800,000 square metres per year for roofing systems

Investor Quota and Listing Date

The IPO has been divided into categories:

- 75 percent for Qualified Institutional Buyers (QIBs)

- 15 percent for Non-Institutional Investors (NIIs)

- 10 percent for Retail Investors

The company is expected to be listed on the stock exchanges on August 6.

Equirus Capital and DAM Capital Advisors are the book-running lead managers handling the IPO process.

(With PTI Inputs)