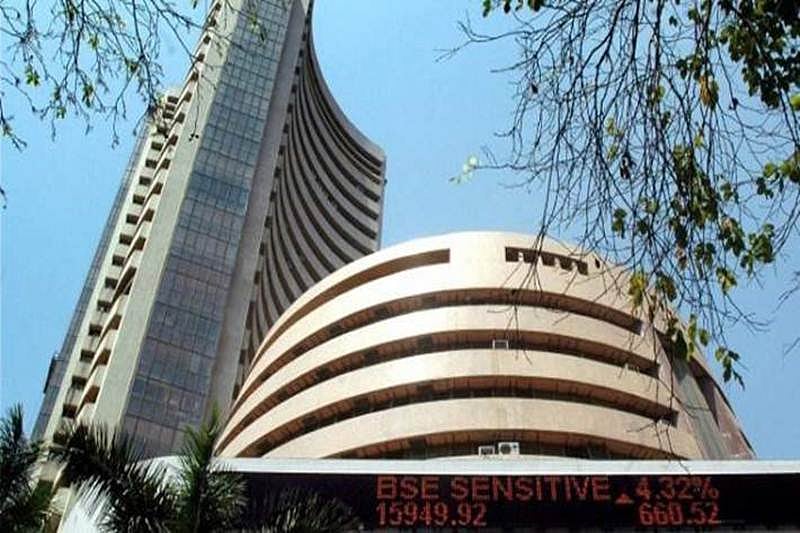

The benchmark indices closed on a weak note for the second consecutive day on April 6 dragged by heavy selling pressure in IT and banking stocks and weak global cues. Oil & gas, power and metal indices gained 1 percent each, while bank and IT indices fell 1 percent each. BSE midcap and smallcap indices ended with marginal gains.

At close, the Sensex was down 566.09 points or 0.94 percent at 59,610.41. The broader Nifty declined 149.70 points or 0.83 percent at 17,807.70. About 2,094 shares have advanced, 1,229 shares declined, and 92 shares are unchanged.

Earlier, the Sensex started the day in the red at 59,815.71 points and slumped to a low of 59,509.84 points in the intra-day. The Sensex had lost 435.24 points or 0.72 percent on Tuesday.

The Nifty had lost 96 points or 0.53 percent on Tuesday.

HDFC Bank and HDFC slumped for the second straight day after the announcement of merger deals. The share price of HDFC Bank and HDFC had surged by around 10 percent on Monday shortly after the merger deals were announced. However, scrip has declined sharply in the past two days on profit booking. HDFC Bank slumped 3.51 percent to Rs 1550.80. HDFC tumbled 3.26 percent to Rs 2536.50.

Among top Nifty laggards were HDFC Bank, HDFC, HDFC Life, HCL Technologies and Tech Mahindra. Coal India, IOC, NTPC, Tata Steel and Power Grid Corp were among the top gainers on the Nifty.

There was heavy selling pressure in IT stocks. HCL Technologies slumped 2.07 percent to Rs 1170.80. Tech Mahindra dipped 1.97 percent to Rs 1459.50. Infosys fell 1.75 percent to Rs 1828.45. TCS fell 1.52 percent to Rs 3756.15. The index heavyweight Reliance Industries closed 0.23 percent down at Rs 2619.35.

There was good buying support in power and metal stocks. NTPC jumped 2.61 percent to Rs 153.05. Tata Steel soared 1.94 percent to Rs 1371. Power Grid Corporation rose 1.52 percent to Rs 236.60. Bharti Airtel, Nestle India, L&T, State Bank of India and Asian Paints were among the major Sensex gainers.

In line with Asian peers, Indian equity benchmarks continued their weak trade in late noon session on account of selling in frontline blue chip counters, saidMohit Nigam, Head - PMS, Hem Securities. Nifty50 and Bank Nifty both closed in red losing 0.83 percent and 1.14 percent respectively. Meanwhile, automobile dealers' body, Federation of Automobile Dealers Associations (FADA) has said domestic passenger vehicle (PV) retail sales in March 2022 declined by 4.87 percent, as compared to the same month last year.

On technical front, Nifty50 may take immediate support and resistance on 17,650 levels and 18,050 level respectively. For Bank Nifty, 37,200 and 38,150 levels may act as immediate support and resistance respectively, Nigam added.

Traders rushed to trim their position further in banking and IT stocks, thus pulling down key benchmark indices sharply lowersaid Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd. Weakness in other global markets and concerns of hawkish US Fed likely to hike interest rates along with caution ahead of RBI's policy meet prompted investors to turn risk averse. The intraday texture of the market has turned weak and a fresh pullback rally is possible only after 17,900 breakout. For traders, 17900 would act as an immediate hurdle, and below the same a weak formation is likely to continue till 17,700-17,650. However, above 17900 the index could move up to 17,820-17,865. The Nifty is having a strong support between 17,650-17,700 and hence contra traders can take a long bet near 17,650 with strict support stop loss at 17,620.

Worst sell-off by FPIs in FY22

Foreign portfolio investors (FPIs) dumped Indian shares worth record Rs 1.4 lakh crore in the financial year 2021-22, after pumping in whopping Rs 2.7 lakh crore in the preceding fiscal, mainly on account of sharp surge in coronavirus cases, concerns over the risk to economic recovery and global turmoil triggered by Russia-Ukraine war.

This was the worst ever exodus by FPIs from domestic equity market. They withdrew Rs 88 crore in 2018-19, Rs 14,171 crore in 2015-16 and Rs 47,706 crore in 2008-09, data with depositories showed. Moreover, experts believe that flows from FPIs are expected to remain volatile in the near term given the headwinds in terms of elevated crude prices and inflation.

World stocks sink amid worries over US rate hikes, Russia

Global stock markets and Wall Street futures sank Wednesday after a Federal Reserve official's comments fuelled expectations of more aggressive US rate hikes and the White House announced more sanctions on Russia.

London and Frankfurt opened lower. Tokyo and Hong Kong fell, while Shanghai was little changed.

All Asian markets were under selling pressure as investors focus on new Western sanctions against Russia over its invasion of Ukraine. Also, Chinese authorities extended a lockdown in Shanghai.

In Asian trading, the Hang Seng in Hong Kong fell 1.9 percent to 22,080.52 and the Nikkei 225 in Tokyo sank 1.6 percent to 27,350.30. The Shanghai Composite Index ended up less than 0.1 percent at 3,283.43 after spending most of the day in negative territory.

The Kospi in Seoul gave up 0.9 percent to 2,735.30 and Sydney's S&P-ASX 200 lost 0.5 percent to 7,490.10.

New Zealand and Southeast Asian markets also retreated, Reuters said.

Twitter stock up

Twitter rose another 2 percent after disclosing an arrangement with Tesla chief Elon Musk that will give him a board seat but also limit how much of the company he can buy while he's a director. The company disclosed a day earlier that the billionaire Twitter critic had become its largest shareholder.

Crude up

US oil rose $1.19 to $103.15 per barrel in electronic trading on the New York Mercantile Exchange. The contract fell $1.32 on Tuesday to $101.96. Brent crude, the price basis for international oil trading, added $1.10 to $107.74 per barrel in London. It declined 89 cents the previous session to $106.64.

Rupee slumps

The rupee slumped 47 paise to close at 75.76 (provisional) against US dollar.

USDINR spot closed 43 paise higher at 75.75 levels, due to short covering demand from dealers and large bids from importers, said Anindya Banerjee, VP, Currency Derivatives & Interest Rate Derivatives at Kotak Securities Ltd. Hawkish comments from the Fed vice chair on April 5 triggered a sharp upmove in US bond yields and the US Dollar Index. This pushed USDINR higher. Tonight (April 6) focus will be on the US FOMC minutes. Traders will seek clarity on the pace of balance sheet reduction and the quantum of the next hike. Over the near-term USDINR is expected to trade within a range of 75.45 and 76.20 on spot.

(With inputs from Reuters)