The benchmark indices have crashed further. At 2.19 PM, the benchmark Sensex was 1,414.98 points down or 2.43 percent at 56,737.94. The broader Nifty was below 17,000 mark. It was down 426.55 points or 2.45 percent down at 16,948.20 points.

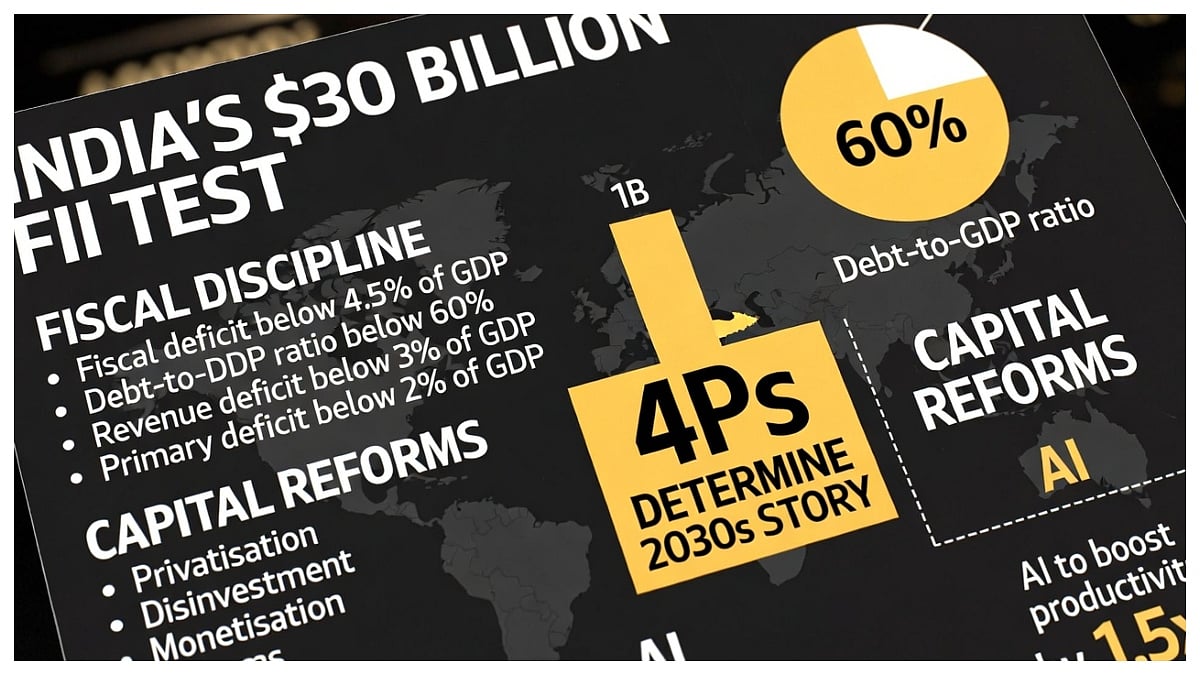

The Indian market witnessed pullback due to Ukraine and inflation concerns, said Aishvarya Dadheech, Fund Manager, Ambit Asset Management. Oil prices can shoot up further if ongoing tussle between Russia-Ukraine escalates or due to any retaliatory sanctions by the US. India will be adversely impacted if crude goes any higher, as India will see higher pressure on its BOP, as well as it will import higher inflation. Market is also anxious that with rising inflation (on crude strengthening), the Fed may act faster than expected on tapering as well as rate hike.

Geo-political tension and the rising crude prices are weighing on investors' sentiments leading to a sharp rise in volatility, and India VIX is up by 15 percent today, said, Naveen Kulkarni, Chief Investment Officer, Axis Securities Last week, US bond yields hit 2 percent in response to the strong payroll data and the multi-decade high inflation, indicating the possibility of further rate hike projection by the US Fed. All the macro-economic developments are leading to volatility in major assets classes including equity, debt, and currency. We expect this increased volatility to hit small / midcaps more than large caps. We believe that the expected increase in volatility should be used by investors to build positions in quality large-cap and midcap stocks as the earning expectations for Indian corporates remain strong. On the domestic front, the market is reacting on subdued IIP data, along with that, the Indian inflation print is due today, which will further guide the direction for the market along with the global cues in the near term