Manba Finance Limited, a NBFC-BL providing financial solutions is set to open its Initial Public Offering (IPO) on Monday, September 23, 2024.

The Issue will be opened for investor to dive on September 23 and is scheduled to close on September 25, 2025.

Here is a detailed look at what you need to know about Manba Finance's first foray into the stock market.

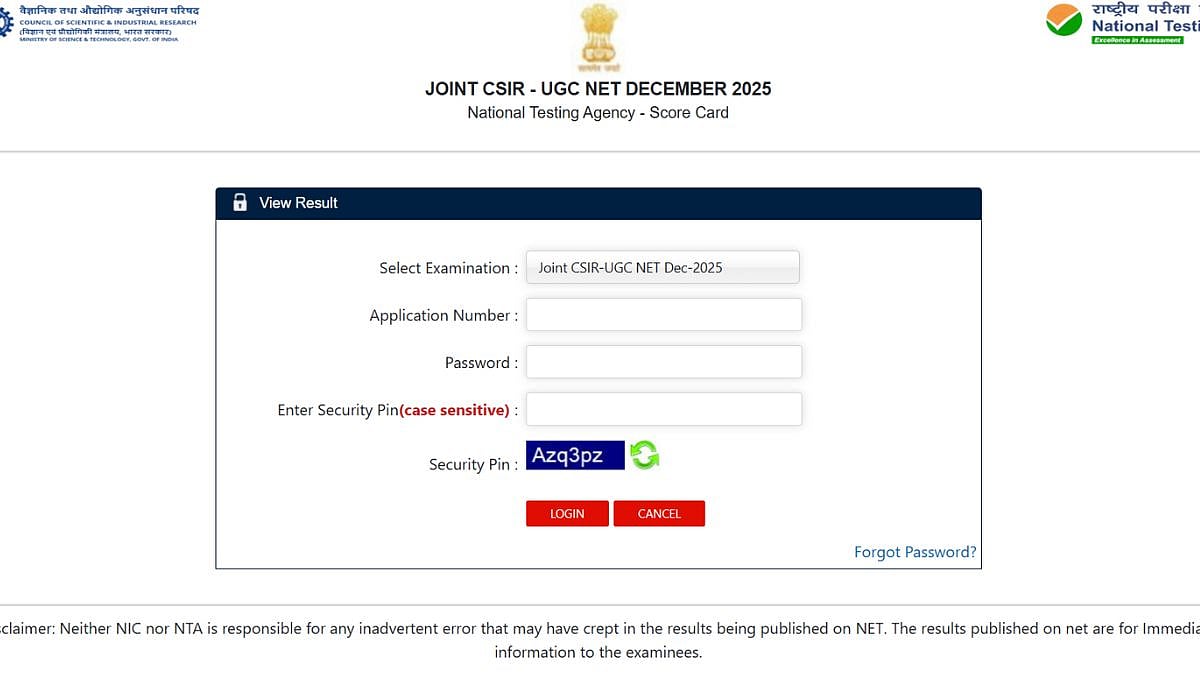

IPO Details

The price band for the public issue is set between Rs 114 to Rs 120 per equity share of face value Rs 10 each for its maiden initial public offer.

The public issue is entirely a fresh issue of up to 1,25,70,000 shares with no offer-for-sale component, meaning the company will be raising new capital to strengthen its balance sheet and meet future growth requirements.

The latest GMP, or Grey Market Price, as of September 18 stands at Rs 0 (GMP details are subject to deviations).

Representative Image |

Allocation and Management

The IPO will be allocated as follows -

Qualified Institutional Buyers (QIBs): Up to 50 per cent

Non-Institutional Bidders (NIBs): At least 15 per cent

Retail Individual Bidders (RIBs): At least 35 per cent

Hem Securities Limited will serve as the sole book-running lead manager, while Link Intime India Private Limited will act as the registrar of the issue.

Financial Highlights

The financial snapshot of the company in the recent years are as follows:

The Assets Under Management (AUM) of the company has surged from Rs 495.82 crore in FY 2022 to Rs 936.85 crore in FY 2024, a compound annual growth rate (CAGR) of 37.46 per cent.

Representative Image |

Furthermore, the company posted a profit of Rs 31.41 crore in FY 2024, marking an 89.50 per cent increase from Rs 16.58 crore in FY 2023. The revenue of the company rose to Rs 191.58 crore in FY 2024 from Rs 133.32 crore the previous year, up by 43.71 per cent.

About the company

Founded in 1998 and headquartered in Mumbai, Maharashtra, Manba Finance Limited is a Non-Banking Financial Company - B (NBFC-BL). The company provides financial solutions for a diverse range of needs, including new and electric two-wheelers (2Ws), three-wheelers (3Ws), used cars, small business loans, and personal loans. It operates 66 locations and 29 branches, catering to urban, semi-urban, and rural areas.