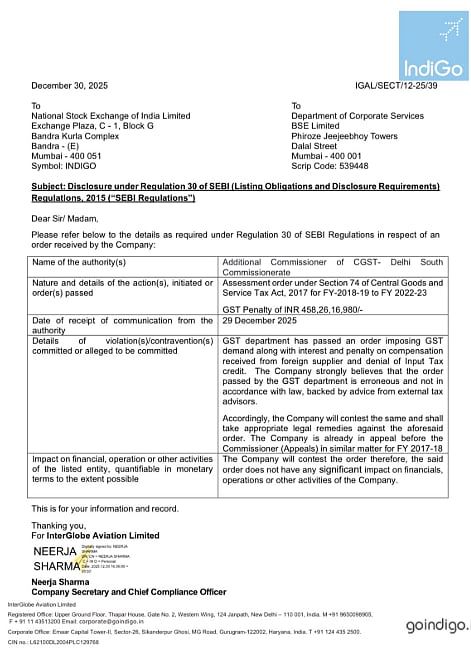

New Delhi: The country's largest airline IndiGo on Tuesday said authorities have slapped a GST penalty of over Rs 458 crore, and that it would contest the decision.

Press Release |

The Additional Commissioner of CGST- Delhi South Commissionerate has slapped the penalty. It pertains to the assessment order under Section 74 of the Central Goods and Services Tax Act, 2017, for FY-2018-19 to FY 2022-23, according to a regulatory filing. The total GST penalty is Rs 458,26,16,980.

"GST department has passed an order imposing GST demand along with interest and penalty on compensation received from foreign supplier and denial of Input Tax credit. The company strongly believes that the order passed by the GST department is erroneous and not in accordance with law, backed by advice from external tax advisors. "Accordingly, the company will contest the same and shall take appropriate legal remedies against the aforesaid order. The company is already in appeal before the Commissioner (Appeals) in a similar matter for FY 2017-18," the filing said on Tuesday.

Further, IndiGo said that since it will contest the order, the order does not have any significant impact on financials, operations or other activities of the company. Separately, the Office of the Joint Commissioner, Lucknow, has imposed a penalty of Rs 14,59,527 on IndiGo for the period 2021-22. "The department has denied input tax credit availed and has raised a demand along with interest and penalty on the company.

The company believes that the order passed by the authorities is erroneous. Further, the company believes that it has a strong case on merits, backed by advice from external tax advisors," InterGlobe Aviation, the parent of IndiGo, said in another regulatory filing. According to the company, it will contest the order before the appropriate authority, and there is no significant impact on its financials, operations or other activities.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.