InterGlobe Aviation on Friday had announced that its non-executive and non-independent director Rakesh Gangwal resigned from the company, with immediate effect. Gangwal wrote a letter to InterGlobe board members saying that he will be reducing his equity stake in the company over five years.

Gangwal and his related entities own around 37 per cent stake in this company. Rahul Bhatia and his related entities own around 38 percent in InterGlobe Aviation.

Gangwal wrote that he has been a shareholder of the airline for more than 15 years. “It’s natural to somebody think about diversifying one’s holdings," he mentioned.

"My current intention is to slowly reduce my equity stake in the Company over the next 5 plus years. While new investors should benefit from the potential future growth in the Company’s share price, a gradual reduction of my stake should also allow me to benefit from some of the upside. Like any plan, future events may impact my current thinking.

"However, I am concerned about the optics of reducing my holdings even though such transactions would only be undertaken when I do not have any unpublished price sensitive information (UPSI). As you are aware, on an ongoing basis, the Company provides us information and some of this is UPSI. Being a co-founder, co-promoter and director, this issue takes on great significance," he added.

Gangwal, a non-executive, non-independent director intends to slowly cut his stake in the company over the next five years, according to an exchange filing.

At an extraordinary general meeting held on December 30, IndiGo shareholders had approved a special resolution to remove a clause from the company's Articles of Association (AoA) which gave its two promoters the power of right of first refusal when one of them wanted to sell his shares.

The passage of the special resolution paved the way for resolution of a dispute that has been going on between Gangwal and Bhatia since 2019. In his letter on Friday, Gangwal said he continues to be a big believer in the long-term prospects of IndiGo and more so now with the industry consolidation underway.

''Under this backdrop and in the long-term, Indian aviation should prosper, as in various other parts of the world,'' he noted.

While new investors should benefit from the potential future growth in the company's share price, a gradual reduction of his stake will also allow him to benefit from some of the upside, he mentioned. '

'Like any plan, future events may impact my current thinking,'' he noted. However, he said he is concerned about the optics of reducing his equity stake even though such transactions can only be undertaken when he does not have any unpublished price sensitive information (UPS).

''As you are aware, on an ongoing basis, the company provides us information and some of this is UPS. Being a co-founder, co-promoter and director, this issue takes on great significance,'' he added. Gangwal said after considerable thought, he sees only one clear path to address this issue.

''Regrettably, and effective immediately, I am stepping off the Board. Accordingly, I ask that no company information be shared with me that is UPS and, having stepped down as a director, there should be no reason to share such information,'' he said. ''Sometime in the future, I shall consider participating again as a board member,'' he added.

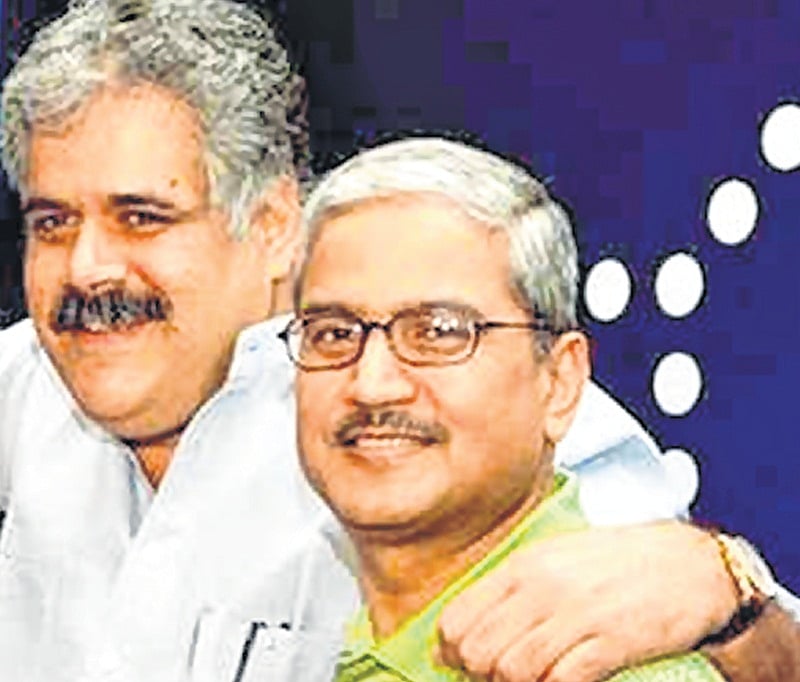

Feud between promoters

The feud between the two promoters -- Bhatia and Gangwal -- came into public domain after Gangwal had written to market regulator Sebi in July 2019 and sought its intervention to address the alleged corporate governance lapses at the company, charges that have been rejected by the Bhatia group.

In 2019, both the promoters had moved the London Court of International Arbitration to resolve their disputes.

The court had passed its order on September 23 last year, following which the aforementioned extraordinary general meeting was called to amend the company's AoA.

(With PTI inputs)