IDFC First Bank on Sunday reported a 78.6 per cent increase in its net profit for the quarter ended March at Rs 127.81 crore.

During the same period of FY20, the bank had reported a net profit of Rs 71.54 crore.

The bank's total income during the fourth quarter of FY21 came in at Rs 4,834 crore, against Rs 4,576.12 crore.

The gross non-performing asset (GNPA) of IDFC First Bank as a percentage of gross advancements was 4.15 per cent during the period under review, up from 2.60 per cent in January-March quarter of the previous fiscal.

The provision for Q4 FY21 was at Rs 603 crore as compared to Rs 679 crore for Q4 FY20 and as compared to Rs 595 crore in Q3 FY21.

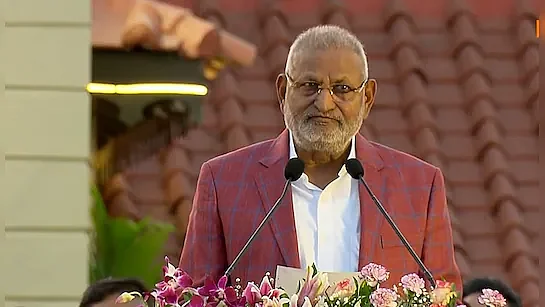

V. Vaidyanathan, Managing Director and CEO, IDFC First Bank said: "Including the equity capital of Rs 3,000 crore raised through QIP on April 6, 2021, our overall capital adequacy is strong at 16.32 per cent. We maintain high levels of liquidity with liquidity coverage ratio of 153 per cent."

"We therefore approach FY 22 with strength and confidence. Strong inflows from retail customers based on our strong brand, our excellent service levels, and strong product proposition has resulted in surplus liquidity at the bank."