The Indian economy has witnessed a phenomenal increase in the repo rate since May 2022. From May 2022 till February 2023, this rate has increased by a total of 250 basis points (bps). To match this massive increase in the repo rate, financial institutions have also increased their fixed deposit rates.

Now, since the FD rate is on the rise, individuals with an objective to secure fixed earnings can invest in this safe and secure instrument.

FD as a secure and fixed-income option

Earnings in investment instruments, such as mutual funds, stocks, and bonds, are not fixed, and individuals cannot predict the rate at which their invested amount will grow. This is because their returns are highly volatile and change from one moment to another. FD is exactly the opposite of these instruments of investments.

Individuals can understand how much their deposits will help them earn right at the time of booking the FD. The booked FD rates remain locked till their maturity period. In fact, after booking an FD, customers get a receipt or certificate that entails every detail of the deposit, including the booked interest rate. All these make FD one of the safest instruments for growing money and securing a fixed income.

To ensure additional safety against fixed deposits, individuals can book an FD with Bajaj Finance. It has been awarded the highest safety ratings, including [ICRA]AAA(Stable) and CRISIL AAA/STABLE. Furthermore, keeping itself aligned with the astounding increase in the repo rate, Bajaj Finance now offers an FD rate of up to 8.10% per annum (p.a.).

Strategies to secure higher FD rates with Bajaj Finance

With Bajaj Finance, individuals can benefit from lucrative annual FD rates, starting from 7.15% by depositing Rs.15,000 to Rs.5 crore. To secure a higher rate, they should ideally keep in mind the following few aspects:

Go for a higher maturity period

With increase in maturity period or tenure the FD rate also increases. Hence, if individuals can keep their money in FD for a longer time horizon, they can earn more on their deposits. For example, the FD rate is 7.40% p.a. for non-senior citizen customers at a maturity period between 19 and 21 months. It increases to 7.85% p.a. at tenure between 40 and 43 months.

Choose the annual payout option

Customers have the option to choose the interest payout, which can be either cumulative or non-cumulative. Cumulative payout lets customers enjoy a higher FD rate compared to the non-cumulative payout option.

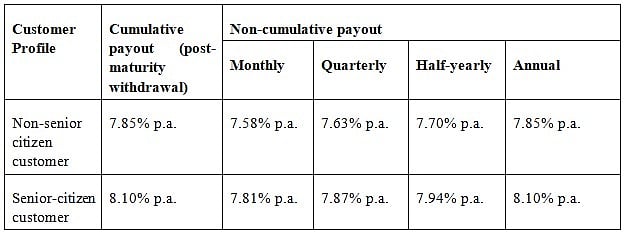

The following table demonstrates the impact of the payout option on the FD rate, when the maturity period is 44 months (FD interest rate for deposits starting at Rs. 15,000 up to Rs. 5 crore w.e.f January 20, 2023):

Although the non-cumulative payout offers relatively lower FD rates, individuals can choose this option if they intend to get the earned interest at a regular interval. They can leverage the earnings to meet their small household expenses.

Book FD for a special tenure

Individuals intending to book an FD with Bajaj Finance at higher FD rates can also go for the special tenure option. There are seven special tenures, including 15, 18, 22, 30, 33, 39 and 44 months. By depositing your money for these maturity periods, individuals can ensure a higher FD rate compared to the immediate next tenure.

Following table illustrates how a special tenure (marked with ‘*’) can benefit customers:

Note: The results are generated by using the Bajaj FD Calculator

Individuals can use the Bajaj Finance FD calculator before booking their deposits with the financial institution. It will help them understand the total amount they will earn at their chosen interest payout, tenure, and investable amount. They simply will have to insert these data in this virtual tool properly.

Now that the FD rates are soaring high due to continuous increases in the repo rate, it can be a profitable time for individuals to deposit their money securely as fixed deposit. The rate they will secure at this moment will remain the same even after their financial institutions decrease their standard rates later. Individuals planning to secure a fixed income can now open their FDs online!