Edmund Hillary and Tenzing Norgay first scaled Mount Everest in 1953. Thereafter, over 4,000 climbers have scaled Everest till this year. In spite of that, the sense of achievement and thrill of scaling Mount Everest remains unparalleled. Gold too is experiencing the thrill of scaling 7- year highs in the gold price. However, gold has scaled its all-time high peak only twice so far.

First, was in 1980 when the yellow metal scaled $850 per ounce from around just around $216 per ounce in the previous year. Second, was in September 2011 when gold scaled $1.926 per ounce intra-day. Now, after being subdued in the last 8-odd years, gold has been on a charge in 2019.

Since the beginning of the current year gold rose by over 7.5% to scale it’s highest since February 2013 at $1,643.30 per ounce (London pm fix). In the last 10 days alone gold gained by over 5%.

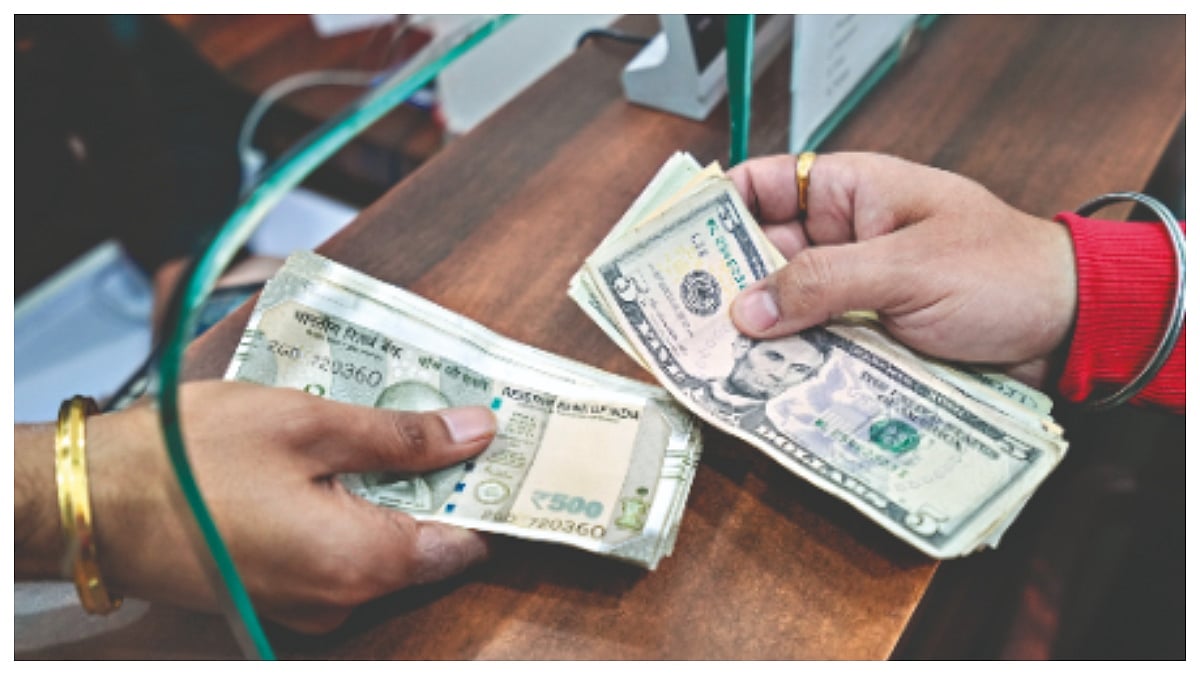

In the domestic market, the yellow metal scaled all-time high levels in Mumbai of Rs.41,742 per 10 gms (IBJA 999 gold) on February 20, 2020. It could open much higher on Monday, February 24, 2020.

The most recent rally in gold has largely been fuelled by the latest tally on account of Covid-2019. So far, over 75,000 people have been affected worldwide of which, only around 900 are outside China.

The death toll is over 2,300 with a few deaths reported outside China. It would appear at this stage that as compared to SARS in 2003, Covid-2019 has more or less been confined to China.

Thereby, limiting the death toll outside China and preventing panic from spreading far and wide. However, even though that may be true, currently the Chinese economy has a far bigger say on global economy than in 2003 (SARS).

Then, China was the 6th largest economy and the cost to China on account of SARS was between 0.5-1%. Today, China is the 2nd largest economy with highest exports as well as fairly high import share. Moreover, its economy has slowed down in recent times to 6%. Therefore, the impact on China itself and the global economy could be much higher and felt throughout the world.

That is what is mainly driving the current price rally in gold. It is not a rush only to a safe haven, but an opportunity for chartists to gain on higher gold price. Most of them are betting long on gold. Then, overbought stock markets could collapse any time faced with fears of a slowdown.

The Central banks worldwide seem more inclined to tolerate high inflation and rate cuts rather than any rate hikes. That in turn would be very bullish for gold. As global economy takes a hit on account of Covid-2019 many of the reserve currencies could take a hit and aid gold in the process.

However, for gold to be in a real full blown bull market there has to be some profit taking by players as only then could the yellow metal find a support level and thereafter, deepen the bull run.

Gold seems poised to take the big leap towards $1,700 per ounce in the short-term. According to some market players/experts gold could scale $2,000 per ounce in a couple of years.

Meanwhile, the Geological Survey of India announced that Sonbhadra district of East UP is sitting on a gold reserve of around 3,000 tonnes which could go up to 5,200 tonnes. However, one should not be enamoured by this “good news” and not consider it as fait accompli.

For, there has been many a miss between the cup and the lip ever since the mining sector was first opened up to foreign miners’ way back in 1995. Apart from technical feasibility, the financial viability of the mine needs to be worked out.

Moreover, as mining is in the concurrent list, there has always been a conflict of interest between the state governments on one side and the central government on the other. Then, environmental issues, the naxal problem in the region as well dealing with politicians and bureaucrats has made mining a nightmare for even any genuine miner.

Only a few years ago Rio Tinto gave up its diamond mine at Bunder that had a potential reserve 27 million carats of diamonds and ready to go for production by 2019-20 to the MP government.

Rio Tinto voluntarily gave up all its mining assets free to the state government after environmental issues were forcing it go for underground mining. The company preferred to give up the mine as otherwise cost escalation would have made the mine not financially viable.

Therefore, one has to wait for events to unfold on the gold mining front before jumping to any conclusions. There is still a long way to go! (DILLI Abhi bahut door hain)

The author is an independent analyst of precious metals and diamonds, who has worked with GFMS and WGC.