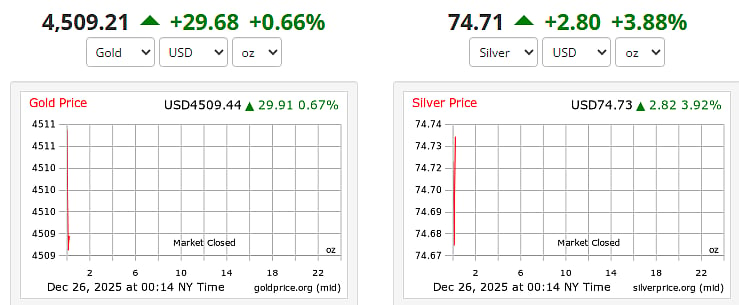

Mumbai: Gold prices shocked global markets after breaking all previous records within just 24 hours. International prices surged close to USD 4,500 per ounce, creating a new all-time high. Investors who already hold gold benefited, while new buyers are now worried about rising costs. The big question is-what caused such a sudden and powerful jump?

Global Fear and War Boost Gold Demand

The biggest reason behind the rally is growing fear across the world. Geopolitical tensions are rising in many regions. The Russia-Ukraine war continues without any clear end, keeping global uncertainty high.

At the same time, reports of disruptions in Venezuela’s crude oil supply raised concerns about global energy security. News of US military action against ISIS in parts of Africa also added to market fear. When such situations arise, investors usually move their money away from risky assets like stocks and turn to gold and silver.

Gold is seen as the safest place to protect wealth during uncertain times. This sudden shift in investor behavior pushed gold prices sharply higher.

Why This Matters for Common People?

For ordinary investors, the message is simple. Whenever fear increases in the world, demand for gold rises. Higher demand naturally leads to higher prices. That is exactly what happened over the last 24 hours.

Interest Rate Cut Hopes Support Gold

The second major reason is changing expectations about US interest rates. Markets now believe that the US Federal Reserve may cut interest rates twice next year. Signs of cooling inflation and a slowing job market have strengthened this view.

When interest rates fall, returns on bank deposits and bonds become less attractive. As a result, investors look for options that can protect value, and gold becomes more appealing. This is why expectations of rate cuts have given strong support to gold prices.

Strong Buying Keeps Prices High

Gold is not rising only because of short-term news. Central banks around the world are buying gold to strengthen their reserves. Gold ETFs are also seeing steady inflows, showing long-term confidence.

In 2025 so far, gold prices have risen more than 70 percent, marking the strongest yearly performance since 1979. Silver is also gaining attention, with many investors calling it 'affordable gold.'

What Lies Ahead?

Gold prices may feel expensive right now, especially for weddings or urgent needs. But as long as global tensions stay high and interest rates remain under pressure, gold’s shine is unlikely to fade anytime soon.