The 2019 –nCoV (the nomenclature for the Wuhan virus now) spread further during the weekend to over 17,300 infected cases and 362 deaths. Moreover, the death toll of 361 in mainland China has already crossed the Sars virus death toll of 349 there. However, the fact is that though the infected cases by n-Cov have more than doubled the Sars cases in 2003 and the death toll in China exceeding the 2003 death toll, its spread across the globe appears to be reasonably under control. Then, as profit booking and professional traders took over, both the stock markets as well as the bullion markets went for a correction on Monday.

The Dow Jones rose by over 300 points intra-day only to limit its rise to a little over 0,51% at 28,399.81, only a partial recovery from the 603 points it shed on Friday. The gold markets too vacillated between $1,581 and $1,569 per ounce during the day. In London it opened at $1578.85 per ounce (am fix) and closed lower at $1,574.25 per ounce (pm fix). But, following the pattern in recent times, it closed in New York in the $1,576-77 per ounce region. In early Asian trading the yellow metal was marginally higher in the 1,577-78 per ounce region. It is expected that lower bond yields and with the USD not being the strongest currency, gold could pick up steam during the week ahead.

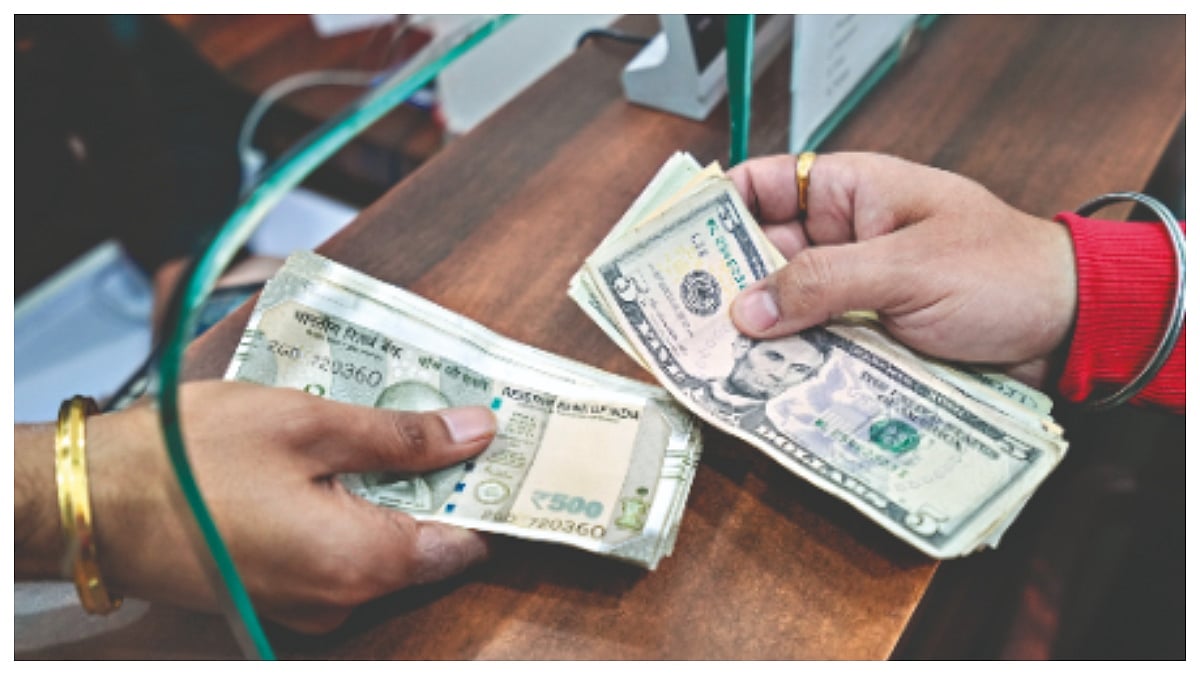

In the domestic market, the BSE Sensex too recovered by around 136 points to 39,872.31, but the recovery was way short of the 988 points it shed post the Union budget. The stock markets would fluctuate on more budget news as well professional traders booking their profits and buying at dips. Gold opened in Mumbai with a gain of Rs.176 at Rs.40,967 per 10 gms.

It closed at Rs.40,817 per 10 gms, a decline of Rs.154, still a shade higher than Friday’s price. Silver on the other hand, opened lower and ended the day much lower at Rs.46,240 per kg, a net loss of Rs.155. Both the precious metals are likely to be volatile based mainly on overseas trends. Moreover, both gold and silver would find it hard to digest the reduction in import duty on both platinum and palladium.

Gold (per 10 gms) am pm

Feb 3 40967 40817

Silver (per kg) am pm

Feb 3 46310 46240