The Reserve Bank of India (RBI) on Thursday (August 8) announced its Monetary Policy decision, keeping the repo rate unchanged at 6.50 per cent for the ninth straight time. This decison was followed after a 2-day Monetary Policy Committee which was held from Tuesday to Thursday during its third bi-monthly policy meeting for the fiscal year 2024-25.

Here are the key highlights from the RBI MPC meeting:

1. Policy rates unchanged: The RBI kept the policy repo rate unchanged at 6.50 per cent for the 9th straight consecutive time.The Standing Deposit Facility (SDF) rate remained at 6.25 per cent and the Marginal Standing Facility (MSF) rate and Bank Rate remained at 6.75 per cent.

GDP Growth projection | RBI

2. GDP Growth projection: The country's real GDP growth for the financial year 2024-2025 is projected at 7.2 per cent. As per this, the quarterly estimates are as follows- Q1 (7.1 per cent), Q2 (7.2 per cent), Q3 (7.3 per cent), and Q4 (7.2 per cent).

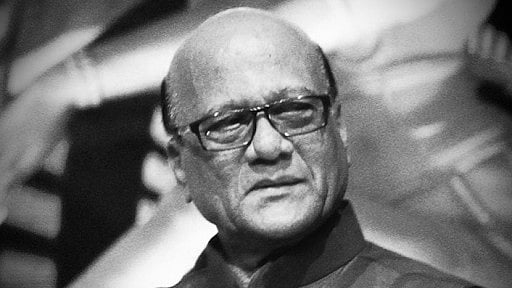

RBI Governor Shaktikanta Das | PTI

3. Focus on Inflation: The MPC continues to focus on controlling inflation and aims to bring it closer to the 4 per cent target.

4. Inflation trends: The headline inflation in the June 2024 surged to 5.1 per cent due to rising food prices such as pulses, vegetables, and edible oils. Firthermore, the CPI inflation is projected at 4.5 per cent for 2024-25, with the highest inflation expected in the third quarter (Q3) at 4.3 per cent.

5. Challenges ahead: Some of the challenges or risk ahead include volatile food prices, potential adverse climate events and geopolitical tensions affecting global commodity prices.

In addition to this, the other challenge may incude that the core inflation (excluding food and fuel) is expected to increase slightly due to factors like increased mobile tariff rates.

Mohit Mittal, CEO of MORES, a real estate investment advisory firm on RBI's Monetary Policy Decision added, "The Reserve Bank of India's decision to maintain the Repo rate at 6.5 per cent for the ninth consecutive time demonstrates a commitment to stabilizing the economic environment amid global uncertainties. This steady stance provides much-needed confidence to the real estate sector, particularly for homebuyers and developers who are keen on making long-term investments. "

"With borrowing costs remaining stable, we can expect sustained momentum in the housing market, as affordable financing options continue to be available. This is especially significant for first-time homebuyers and the affordable housing segment, where interest rates play a critical role in decision-making," he added.

MPC Voting

Most members voted to keep the policy repo rate unchanged at 6.25 per cent and continue focusing on controlling inflation. Two members suggested reducing the repo rate by 25 basis points and shifting to a neutral stance.

Next MPC Meeting

The next MPC meeting is scheduled for October 7 to October 9, 2024.

Raj Yadav, Managing Director, Navraj Group, on RBI's Unchanged Repo Rate at 6.5 commended, "We welcome the Reserve Bank of India's decision to maintain the Repo rate at 6.5% for the ninth consecutive time. This stability is crucial for the real estate sector, particularly in the luxury residential and commercial segments, as it fosters an environment of predictability and confidence among investors and homebuyers alike."

"The unchanged rate helps keep borrowing costs steady, which is beneficial for both developers and end-users. For developers, it means continued access to affordable capital, essential for the timely completion of ongoing projects and the initiation of new ventures. For buyers, especially in the luxury market, it offers sustained access to favourable home loan rates, encouraging investment in premium properties," added.