To stem the spread of the coronavirus pandemic, countries have announced lockdowns, travel bans, closed borders and shut down of non-essential businesses, effectively bringing to halt conduct of the normal economic activity.

In order to cushion the economic fallout of these measures and to enable the revival of business activity, a large number of global central banks have announced emergency rate cuts and monetary policy measures since February'20. National governments too have announced a raft of measures to soften the impact of the disruptions caused by the pandemic.

The effectiveness and adequacy of the conventional monetary and fiscal policy measures to address the demand shock that has emerged from the pandemic is being debated.

Markets have been factoring contraction in the global economy in the coming months and that could probably explain the steep fall in the markets in recent days, despite the announcement of the various monetary and fiscal measures.

The revival of the global economy would depend on the recovery in demand. This in turn would be contingent on the measures being undertaken by governments to contain the spread of the virus and to build confidence among people about the prevention and effective treatment which could in turn prompt them to resume movement and consumption of goods and services.

Examined here are the recent monetary actions of global central banks and the various fiscal stimulus measures being announced by governments across countries to tackle the impact of the virus led economic disruptions. The market reaction to these measures has also

been included along with Indian policy response to the pandemic.

Rate cuts have been the preferred monetary policy response of global central banks

Over the last few days, a number of central banks have held unscheduled monetary policy meets, in many cases just days ahead of their scheduled meetings, to announce interest rate cuts and wide ranging monetary policy measures in what can be seen as an attempt to avoid a credit crisis. Some major central banks have not announced rate cuts viz. the European Central Bank, Bank of Japan, Riksbank (Sweden) and Reserve Bank of India but have undertaken measures to boost liquidity and credit flows while assuring markets that they stand ready to take additional steps to support the economy.

Interest Rate Action of Central Banks

• 36 central banks have cut interest rates so far this month (1 -18 Mar’20), of which 11 central banks cut rates twice in the span of a fortnight. These include Australia, Bahrain, Canada, Hong Kong, Iceland, Kuwait, Macau, Qatar, UAE, USA and Saudi Arabia.

• After the Federal Reserve’s emergency rate action (100 bps rate cut) on 15 March’20, 25 central banks followed suit and cut rates.

• 42 central banks have reduced their interest rates since 1 February 2020. The rate cuts have ranged between 10 bps -1000 bps.

• 2 countries i.e. Kazakhastan and Kyrgystan hiked rates during this period. The Czech Republic had raised rates by 25 bps in Feb’20 and subsequently cut by 50 bps in March’20.

• 18 central banks have cut interest rates by 100 bps and above since February 2020.

Table 1: Rate Cut by Global Central Banks during February- March 2020

Source: Trading Economics. *Czech Republic had raised rates by 25 bps in Feb’20 |

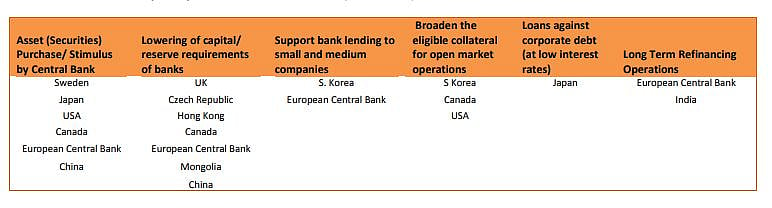

Monetary policy measures

Some central banks have announced additional policy measures primarily aimed at injecting money into the financial system and to facilitate credit supply/ lending to households and businesses. These measures included additional buying of securities by the central banks, relaxation in capital/ reserve requirements of banks, including new instruments as eligible collaterals for open market operations, providing loans against corporate debt instruments and undertaking long term refinancing operations.

Asset purchase and lowering of capital requirements that would provide funds to banks for lending have been among the recurring measures proposed by central banks.

Table 2: Recent Monetary Policy measures of central banks (Feb-Mar’20)

Source: Reuters, Bloomberg and central banks |

Fiscal support underway

In what can be seen as an acknowledgment that central bank rate cuts on its own will not be able to address the economic impact of the disruptions caused by the corona virus, many countries have either outlined or are considering fiscal support measures which could involve a few trillion dollars.

Governments have announced/ planning economic stimulus packages (beyond annual budget), providing loan guarantees, undertaking targeted direct cash payments, deferring tax and statutory payments, enabling debt negotiations, loan payments deferred, aid to stressed sectors, leave benefit for employee, tax cuts among others.

Table 3: Planned Fiscal Measures by National Governments

The fiscal support being extended for the majority of countries is mainly through government loans and higher public spending.

How markets have reacted to the monetary and fiscal measures?

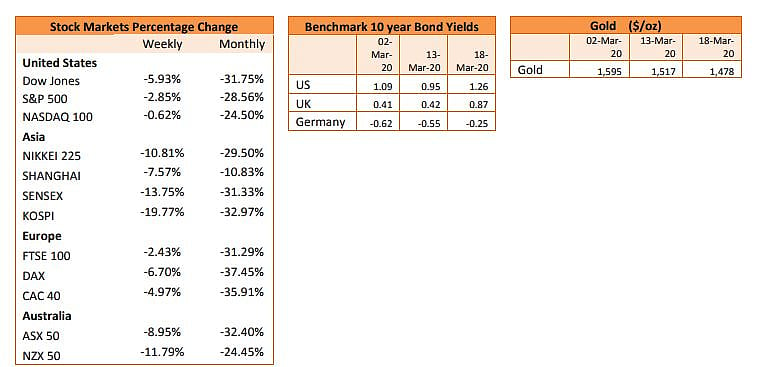

The recent monetary action of central banks and fiscal stimulus measures has failed to improve investor sentiments or assuage fears over the pandemic. On the contrary it has heighted fears over impending global recession. This was iterated by the sharp fall in equity markets across regions in the last 1 month.

Table 4: Market Movement

Source: Trading Economics |

Key stock indices in the United States, Europe, Asia and Australia have on an average declined by 30% in the last 1 month. Even with the slump in the stock markets, traditional safe haven assets like government securities and gold fell. This can in part be attributed to investors resorting to selling government securities and gold to cover losses suffered in the equity markets.

Also, fears of an extended shutdown is giving rise to risk aversion and is leading to reduced exposure across asset classes with growing preference for cash. Investors have been increasing holdings of US dollars leading to a shortage on US dollars in the global markets. This has prompted the US Federal Reserves to reduce the price of dollar swap lines with the central banks of Canada, the U.K., Japan, Switzerland, and the European Central Bank.

Effectiveness of monetary and fiscal policy measures

The adverse market reaction in recent days following the interest rate cuts by central banks and fiscal support implied that the availability of liquidity and cheaper funds will not help resolve the worsening health crisis nor would it reverse the economic damage being caused by the shutting down of businesses, restriction on travel and destruction of demand.

With panic led lockdown of cities and countries, making available cheaper funds for production and investment may not be very effective. Moreover, these measures do not help clear uncertainty over how long the crisis would last for or how deep it can go. The sharp and sudden rate cuts by the major central banks to record lows viz. the Federal Reserves has also raised concerns over how dire the situation is to warrant such a move and if there are adequate policy tools available

if the situation worsens. However, all such measures do provide a modicum of confidence to the citizens that the central banks are doing their bit to counter the negative effects of the epidemic. Such measures would be useful once the epidemic passes by and funds required for fostering growth.

Conventional fiscal policy measures such as government guaranteed loans, tax cuts and deferments; public spending may not help stimulate demand, economic activity or investments in the scenario of lockdowns or restricted movement. Even with the easing of restrictions, demand would be low in many sectors (viz. travel, tourism, hospitality, entertainment among others) with movement of people expected to be lower until the time there is a definitive medical response for the prevention and treatment of the virus.

Fiscal support that is geared to limit and contain the spread of the virus, providing for quality health services, developing vaccines could be more effective in building confidence among people which could in turn prompt them to resume movement and consumption of goods and services

The Indian Response

So far, the spread of the virus in the country although increasing has been limited in terms of population detected with the disease and the extent of shut down of economic activity (which is more in consumer-oriented services). The government (central and state governments) on its part has been undertaking precautionary suspensions and closures to tackle the spread of virus. No fiscal measures have been announced up till now.

On the monetary side, the RBI has not yet opted for an interest rate action even as it continues to maintain an accommodative monetary policy stance. It has instead recently (16-Mar’20) announced measures to enhance liquidity (through long term repo operations) in the system and limit the volatility in the rupee (through USD/INR Sell Buy swap auction). The central bank also assured markets that it stands ready to take the necessary measures and has several tools at its disposal to address the impact of Covid19 pandemic on the Indian economy, which could be deployed if required even ahead of the next monetary meet scheduled for 2 April’20.

The widening spread of the virus domestically and globally has led to sharp decline in the Indian financial markets, led to outflow of foreign funds and consequently the depreciation in the rupee. The benchmark equity indices have declined by over 30% in the last 1 month, foreign outflows in March’20 have surpassed $8 bn and the rupee has depreciated by over

2% during 1-18 March’20.

CARE Ratings’ View

With the number of corona virus cases increasing in the country and the government ordering the shutdown and scaling down of activity, various segments of the economy are being affected. This would no doubt adversely impact economic output and employment across sectors. This could prompt the RBI to undertake a rate cut of 50bps on or before it upcoming monetary policy meet on 2 April’2020, despite the prevalence of underlying inflationary concerns.

The government should undertake fiscal measures to contain the spread of the virus and to support the economy. The expenditure on healthcare has to be increased so as to ensure wide spread and quick testing of the virus. This can limit the spread of the disease and could help in the faster recovery of the economy.

With the decline in economic activity, the government tax revenues are expected to fall. This along with the higher expenditure the government may have to incur to tackle the pandemic and revive the economy would necessarily see the government revising its fiscal deficit target of 3.5% of GDP for FY21. There could be a 0.5% slippage in the fiscal deficit for the year.

Kavita Chacko is a Senior Economist at Credit Analysis & Research Limited (CARE Ratings)