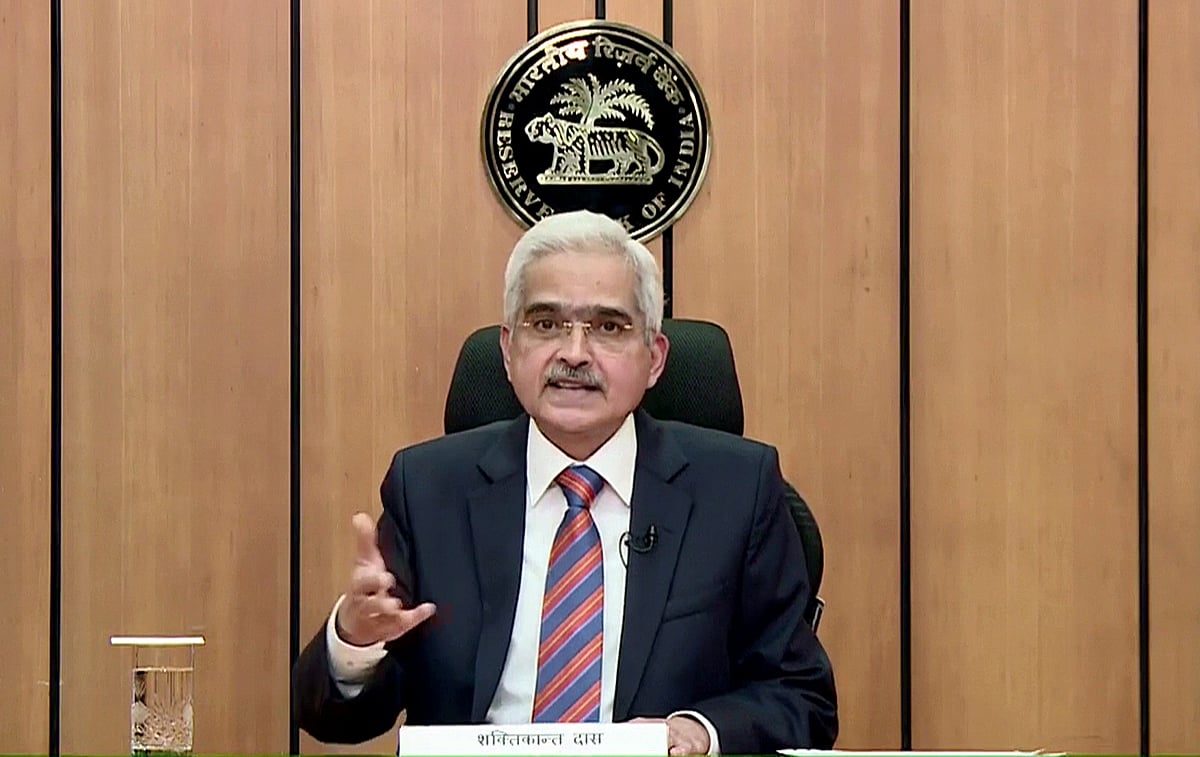

On Friday, the Reserve Bank of India (RBI) announced its bi-monthly monetary policy. Governor Shaktikanta Das made the annoucement regarding a slew of measures decided upon by the committee.

Here are key takeaways from RBI's Monetary Policy:

RBI on Friday kept the repo rate unchanged at 4% and maintained the policy stance at accommodative.

The RBI's Monetary Policy Committee (MPC) made a unanimous decision to maintain status-quo after a three-day meeting that began on December 2.

The reverse repo rate also remains steady at 3.35 per cent, RBI Governor Shaktikanta Das said. He added that the MPC will maintain the accommodative stance "for as long as necessary."

RBI on Friday said it expects the economy to record positive growth in the second half of the current financial year.

The economy contracted by 23.9 per cent in the first quarter and 7.5 per cent in the second quarter on account of the COVID-19 pandemic.

"The second half is expected to show some positive growth," RBI Governor Shaktikanta Das said, adding that during the financial year as whole the economy was likely to contract by 7.5 per cent, which is an improvement over its previous projection of 9.5 per cent contraction.

In October, the RBI had projected the contraction in gross domestic product (GDP) at 9.5 per cent.

Das said the GDP is expected to turn positive in the third quarter and expand at 0.1 per cent. The last quarter is likely to see an expansion of 0.7 per cent.

Hence, the growth in second half of the fiscal is expected to show a positive growth.

Das said retail inflation is likely to remain elevated and pegged it at 6.8 per cent for the third quarter of the current fiscal.

RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) is of the view that inflation is likely to remain elevated, barring transient relief in the winter months from prices of perishables.

However, retail inflation is projected to be 5.8 per cent in the fourth quarter of 2020-21.

CPI inflation rose sharply to 7.3 per cent in September and further to 7.6 per cent in October, RBI Governor Shaktikanta Das said while unveiling its bi-monthly monetary policy review.

In order to expand adoption of digital payment in a safe and secure manner, he said, it has been decided to enhance the limits for contactless card transactions and e-mandates for recurring transactions through cards and UPI from Rs 2,000 to Rs 5,000 from January 1, 2021.

This will depend on mandate and discretion of customers, he said.

Contactless card transactions and e-mandates on cards (and UPI) for recurring transactions have enhanced customer convenience in general while benefitting from increased use of technology, the statement on Developmental and Regulatory Policies by the Reserve Bank of India (RBI) said.

In order to strengthen security controls around the digital payment systems, the Reserve Bank of India (RBI) on Friday proposed to issue Digital Payment Security Controls Directions, 2020 for regulated entities.

The directions proposes to set up a robust governance structure for digital payment systems and implement common minimum standards of security controls for channels like internet, mobile banking, card payments, among others.

In a business-friendly move, RBI on Friday said that the Real Time Gross Settlement (RTGS) system, used for large value transactions, will be made available round-the-clock in the next few days.

In December 2019, the National Electronic Funds Transfer (NEFT) system was made available on a 24x7x365 basis.

Currently, RTGS is available for customers from 7.00 am to 6.00 pm on all working days of a week, except second and fourth Saturdays of every month.

In view of the economic shock caused by the COVID-19 pandemic, RBI on Friday asked scheduled commercial banks and co-operative banks not to make any dividends for the financial year ended March 2020.

RBI said it is imperative that banks continue to conserve capital to support the economy and absorb losses if any.

The decision is based on review of the September quarter financial performance of banks.

In response to the pandemic, RBI has focused on resolution of stress among borrowers, and facilitating credit flow to the economy, while ensuring financial stability, Das said.

RBI has decided to come out with guidelines for dividend distribution by NBFCs.

Unlike banks, currently there are no guidelines in place with regard to distribution of dividend by NBFCs.

Das on Friday announced that keeping in view the increasing significance of NBFCs in the financial system and their interlinkages with different segments, it has been decided to formulate guidelines on dividend distribution by NBFCs.

Different categories of NBFCs would be allowed to declare dividend as per a matrix of parameters, subject to a set of generic conditions.

A draft circular in this regard will be issued shortly for public comments.

RBI on Friday allowed regional rural banks (RRBs) to access the liquidity adjustment facility (LAF), marginal standing facility (MSF) and call or notice money market, aimed at facilitating better liquidity management for these lenders.

At present, RRBs are not permitted to access the liquidity windows of the RBI as well as the call or notice market.