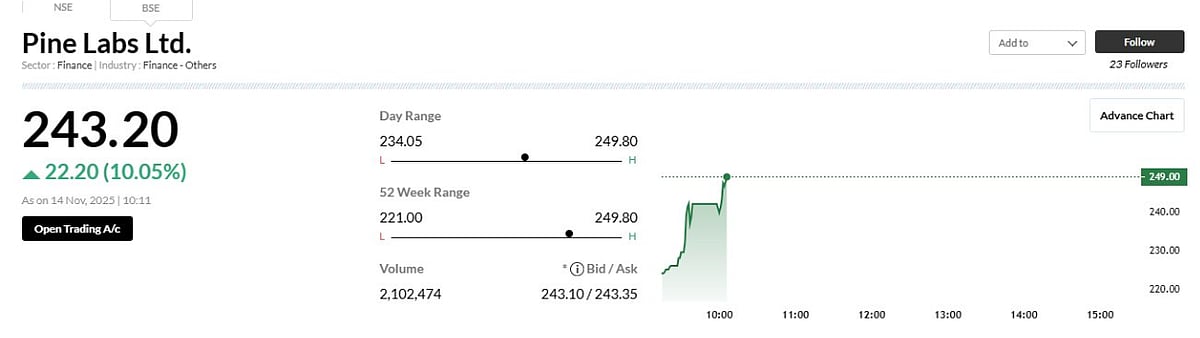

New Delhi: Shares of fintech firm Pine Labs made a firm market debut on the bourses on Friday, listing wth a premium of 9.5 per cent against the issue price of Rs 221.The stock began trading at Rs 242 apiece, a 9.5 per cent premium on both the BSE and the NSE.Later, the company's shares surged 24.43 per cent and 24.36 per cent to Rs 275 and Rs 274.85 per share on the NSE and BSE, respectively.

File Image |

The company's market valuation stood at Rs 31,118.29 crore on the NSE and Rs 31,095.32 crore on the BSE.The markets are trading in the negative territory. The 30-share BSE Sensex declined 302.63 points, or 0.36 per cent, to 84,176.04 while NSE Nifty fell 88.20 points, or 0.34 per cent, to 25,790.95.

On Tuesday, the final day of the share sale, the Pine Labs IPO received 2.46 times subscription.Fintech firm Pine Labs on Thursday raised Rs 1,754 crore from anchor investors.The firm has fixed a price band of Rs 210-221 per share for its IPO, targeting a valuation of over Rs 25,300 crore.The IPO comprises a fresh issue of shares worth Rs 2,080 crore and an offer for sale (OFS) of over 8.23 crore equity shares, valued at Rs 1,819.9 crore at the upper end, by existing shareholders.

The company will use proceeds from the fresh issue to repay debt, invest in IT assets, fund cloud infrastructure, support technology development initiatives, and procure digital checkout points.The company will use funds to invest in its subsidiaries, such as Qwikcilver Singapore, Pine Payment Solutions (Malaysia), and Pine Labs UAE, to expand its presence outside the country.

Noida-based Pine Labs is a technology company focused on digitising commerce through digital payments and issuing solutions for merchants, consumer brands, enterprises, and financial institutions.The company competes with the likes of Paytm, Razorpay, Infibeam, PayU Payments, and PhonePe in the domestic market, and with Adyen, Shopify, and Block in overseas markets.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.