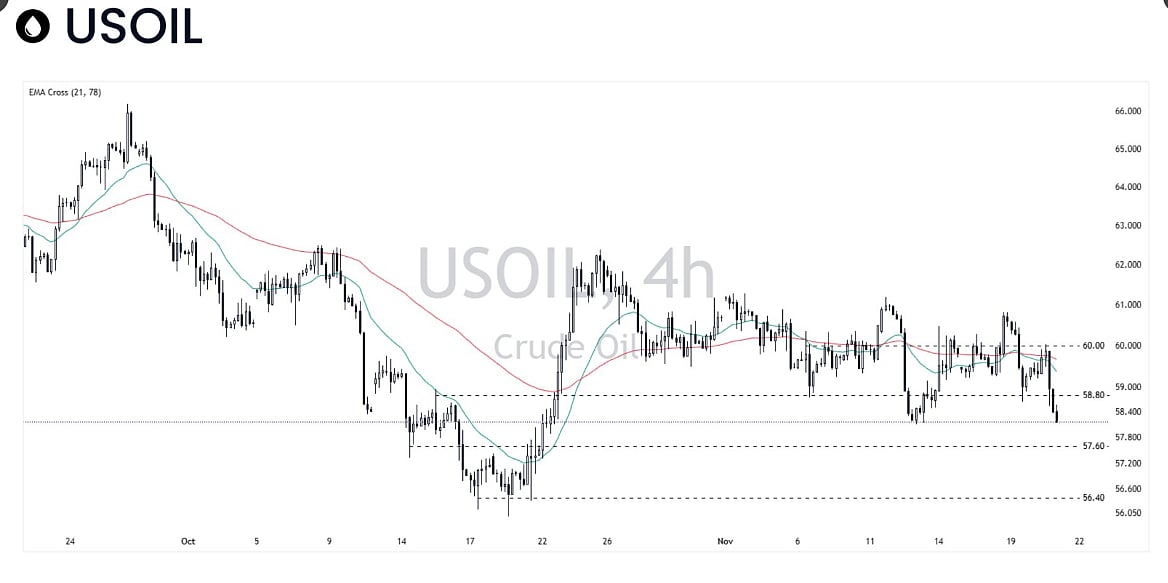

New Delhi: Crude oil prices on Friday declined Rs 82 to Rs 5,181 per barrel in futures trade tracking weakness in global markets as a strong US dollar and renewed diplomatic moves for a Russia-Ukraine peace deal temper the investor sentiment.On the Multi Commodity Exchange, crude oil for December contract decreased by Rs 82, or 1.56 per cent, to Rs 5,181 per barrel in a business turnover of 16,396 lots.

File Image |

In the international markets, West Texas Intermediate (WTI) crude oil for January 2026 delivery was trading 1.17 per cent lower at USD 58.32 per barrel, while Brent Crude for the January 2026 contract declined 1.03 per cent at USD 62.73 a barrel in New York.

"Crude oil prices continued to decline, weighed down by a stronger US dollar index and Washington's renewed push for a Russia-Ukraine peace agreement. The dollar index remained firm above the 100 mark, restricting gains across commodities," Rahul Kalantri, Vice-President of Commodities, Mehta Equities Ltd, said.President Donald Trump has reportedly submitted a draft peace framework and urged the Ukrainian counterpart Volodymyr Zelenskyy to consider it.

"A potential ceasefire could lead to higher Russian oil flows into global markets, exerting fresh pressure on crude prices," Kalantri said."However, expectations of Chinese stimulus for the housing sector and the reopening of the US government are likely to support oil demand, offering some cushion at lower levels. We expect crude oil prices to remain volatile," he added.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.