Jindal Stainless Limited (JSL) has earned an outlook upgrade of ‘Positive’ from ‘Stable’ from the CRISIL Ratings on the long-term bank facilities and debt program, and a reaffirmed rating at ‘CRISIL AA-’, the company announced through an exchange filing. Meanwhile, the rating on the short term bank facilities has been reaffirmed at ‘CRISIL A1+’. The rating agency has revised its outlook in view of the Company’s improved business risk profile, an expected uptick in scale and forward integration with capacity expansion and acquisitions.

Some of the parameters that CRISIL Ratings took note of in order to elevate the outlook include the completion of the merger process of Jindal Stainless Hisar Limited (JSHL) with the Company, the healthy financial risk profile of the Company led by strong liquidity, its strategic acquisitions, an agile business model, and its capacity expansion to 2.9 million tonnes per annum. The Company’s leadership position in the domestic stainless steel industry, efficient working capital management along with healthy demand outlook and sizable export presence were some of the other factors that contributed to the revised outlook.

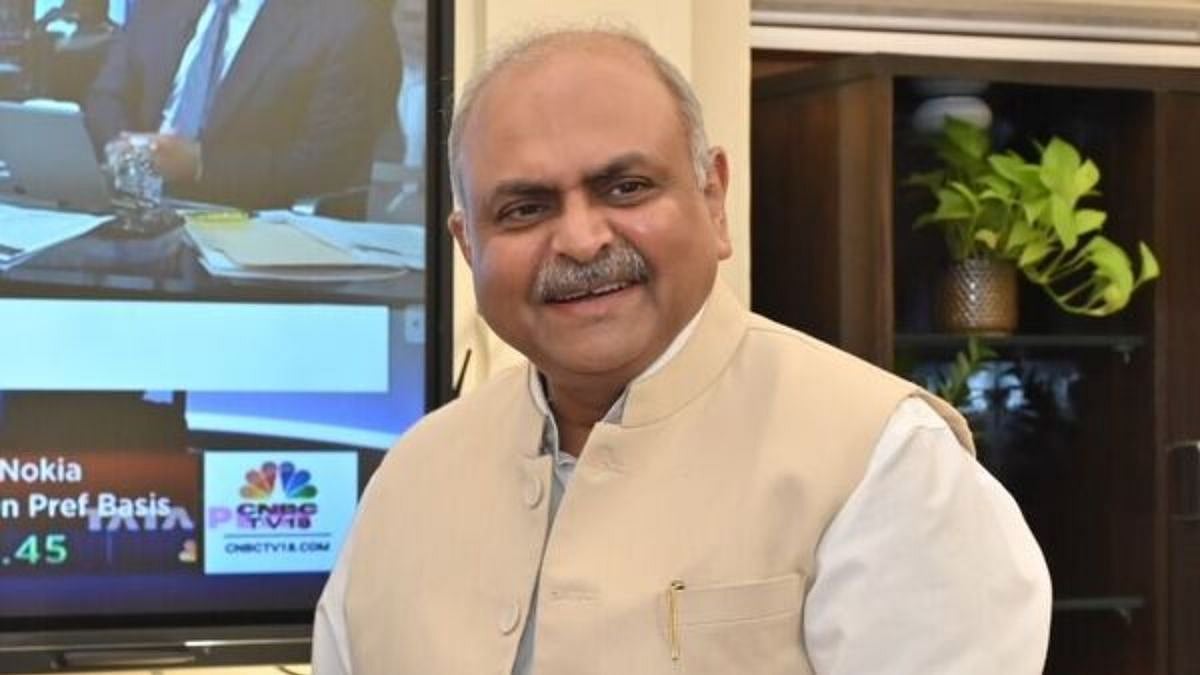

Commenting on the development, Managing Director, Jindal Stainless, Mr Abhyuday Jindal said, “The upgraded outlook by CRISIL Ratings is a significant recognition of Jindal Stainless’ strong business fundamentals and its commitment to mitigating environmental and social risks. With our focus on creating a sustainable ecosystem, enhancing our melting capacities to fulfill the growing stainless steel demand and improving our environmental, social, and governance profile, we will continue to deliver the best-in-class stainless steel solutions to India and the world.”

As per the report, a strong domestic demand outlook has led to significant capital expenditure, which, along with operating efficiency, has led to sustainable improvement in EBITDA per tonne. Despite capacity addition, the Company’s financial risk profile is expected to remain healthy. According to CRISIL Ratings, the business risk profile of the Company will continue to improve, given its focus on high-margin segments, synergies arising from its recent acquisitions, and completion of its planned capex in fiscal 2024. Financial risk profile is expected to remain healthy despite capex, aided by sustenance of its margin profile.