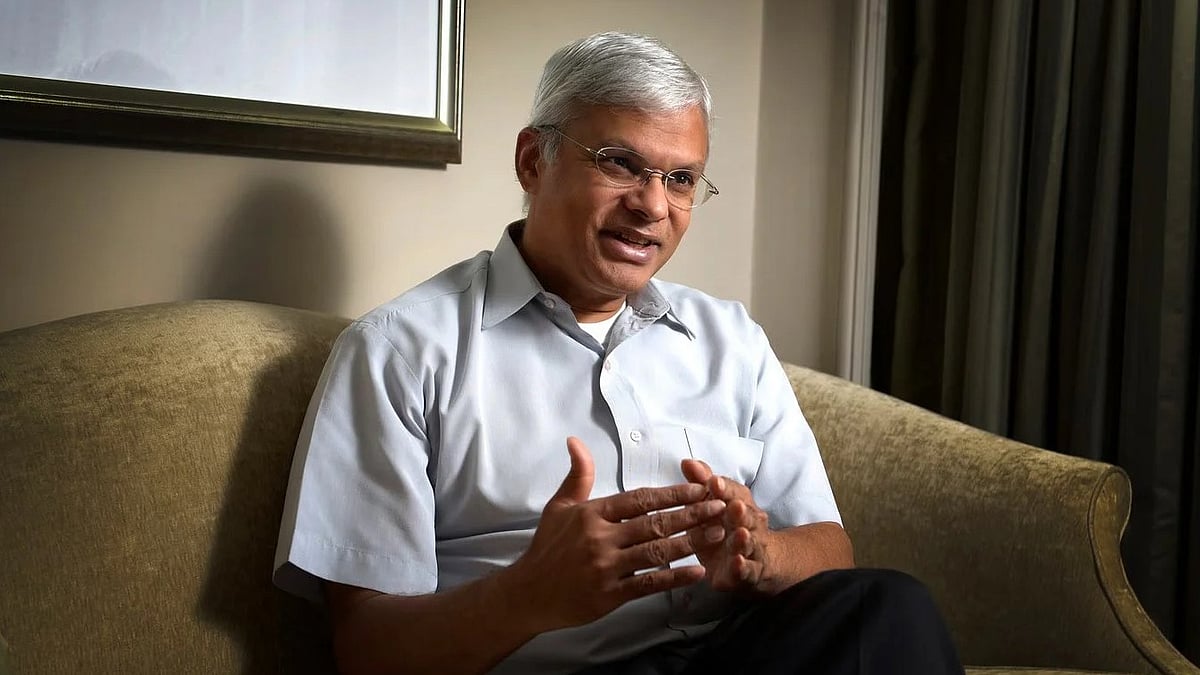

Godrej Agrovet released its Q1 profit last week. The second wave of Covid-19 ‘significantly’ impacted economic recovery seen in the preceding quarter, especially in rural India which had a much stricter lockdown, said Managing Director BS Yadav.

Yadav spoke with Sulekha Nair on the roadmap ahead:

Excerpts from the conversation:

Godrej Agrovet’s consolidated net profit was up in Q1. What were the factors that contributed for this growth?

Top line grew 28 per cent but bottom line PAT grew only about 4 per cent. One of the reasons for this high topline growth is commodity inflation and very good growth in animal feed volumes. So, animal feed volumes grew about 18 percent which is unprecedented for Q1. We have done very, very well. In oil palm business, since oil prices more than doubled in last one year, we got benefit from that. All raw material prices are very high as far as animal feed is concerned. So it is a combination of higher volume and inflation.

How do you see the demand for animal feed in the country?

Animal protein markets have shrunk 10-20 percent depending on animal protein category but our market share has gone up significantly particularly in poultry, cattle and shrimp feed. The reason has been that we have been maintaining consistent quality. A lot of our R&D initiatives have given us an edge over the competitors and I must also acknowledge the fact that this time has not been very good for small operators. So, we have got benefit of their market share also.

One of our bright performance was in broiler feed segment which is part of poultry feed where our growth has been extremely good and that has been primarily due to our getting market share in geographical areas where we were reasonably unrepresented. That has helped us gain market share in areas where our representation was not very good—east, southeast and central India.

How are you gearing up for the third COVID wave?

We are doing so on multiple levels. I think one of the best things we did in the first wave was that we made sure there was zero contact in operations in all our factories, in sales and offices, etc. Everything has been digitised. Earlier, the truck drivers would have to get down to move documents from one place to the other. Today we receive almost 100,000 tonnes of raw materials in our factories and the driver doesn’t have to get out of the truck. Similarly, most of our processes are designed that there are no human interactions amongst people also. Most of the meetings, including lot of sales calls are now being done using new technology, and India has adapted well to those technologies. In the last three months starting mid-May, we have been vaccinating all our employees, their dependents, contract workers, their dependents, our partners, etc. So as a group, we have vaccinated thousands and thousands of people every week.

How do you view the competition?

Yes, competition is going to be stiffer because the pie has become smaller but it will be more focused on bigger companies who have more resources. You will see a lot of consolidation in the industry in the time to come. Even though people recover, my sense is that ultimately a lot of people will leave the industry because of these patches of high losses. My sense is that there will be a lot of consolidation in the animal protein industry and the sector is up for a change.

Many startups have now entered the agro industry sector.

This is the best news for our sector as startups bring cutting edge technology in all areas of our business, including financial, inclusion, aggregation, quality, input etc and my sense is that all these startups will contribute greatly in the next 10 years to sophisticate agri-value chains in this country and capture more and more value for all stakeholders. So I am very optimistic and I am very happy. Having said that I must also tell you that this is a tricky business. There are two important things in this business: one is regulatory framework of the government and the state governments, and the facilitator for these startups will be the three farm laws which have made aggregations, movement, logistics, etc much easier. So, that will be a critical thing which will result in creating or facilitating an environment or ecosystem where they can succeed.

The second thing is that the sector is so big and so diverse that these people will have to choose where they play. If they try and do too many things, they will spread themselves thin and vanish--which will happen to almost 50-60 percent of startups.

All these people who meet me, all these startups who come for some kind of advice or mentoring—they have to work on making the revenue model sharper.

Godrej Agrovet is part of one fund called Omnivore Capital—a venture capital fund where we look at all the startups they invest in. For us, it is only worth our while when the startup achieves some scale or marches toward profitability, which we would like to see before buying them out.