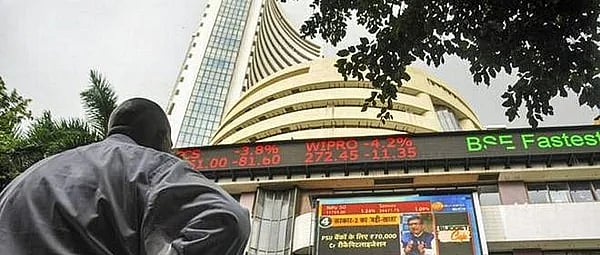

On Wednesday, stock markets snapped their two-day losing streak, gaining in Wednesday's trade, even as caution prevailed in other Asian peers ahead of the U.S. Federal Reserve's policy statement due later in the day.

The BSE Sensex rose 457 points to end the day's trading at 55,816, while the Nifty index closed 157 points up to close at 16,641. However, the small-cap index continued to underperform.

An IMF cut to India's economic growth outlook kept investor sentiment in check.

The Fed is widely expected to hike rates by 75 basis points, with markets pricing about a 10% risk of a larger increase and watching for any shift in rhetoric.

Meanwhile, the International Monetary Fund, in an update of its World Economic Outlook on Tuesday, cut India's 2022 growth forecast to 7.4% from 8.2% in April, citing less favourable external conditions and more rapid policy tightening.

Construction major Larsen & Toubro gained 3% after beating estimates for quarterly profit.

Bajaj Finance on Wednesday reported a 159 per cent year-on-year (YoY) rise in consolidated net profit at Rs 2,596 crore for the June quarter compared with Rs 1,002 crore in the same quarter last year.

SIS Ltd has reported a 39 per cent rise in net profit to Rs 83 crore for the first quarter ended June 30, aided by higher revenue. The company had posted a net profit of Rs 60 crore in the April-June quarter of the preceding fiscal.

Maruti Suzuki on Wednesday reported a 129.76 per cent year-on-year (YoY) surge in net profit at Rs 1,012.80 crore in the June quarter compared with Rs 440.80 crore in the same quarter last year.