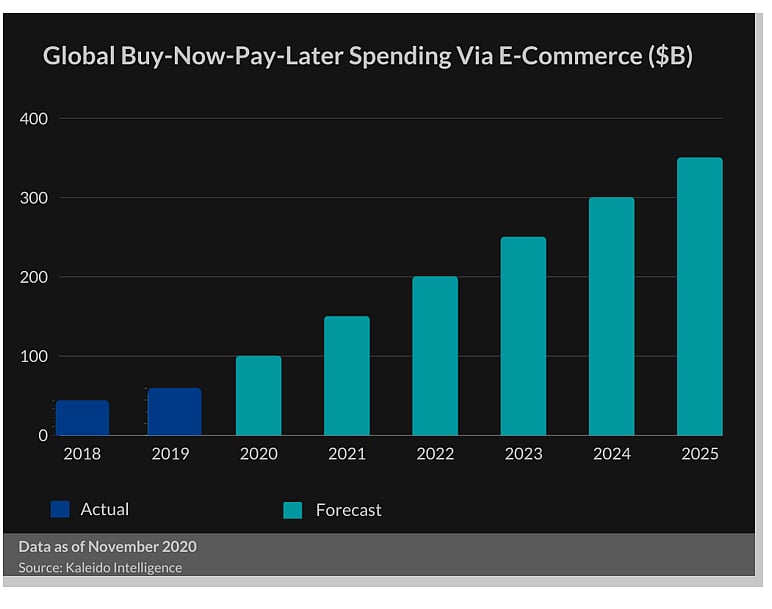

Globally, the Buy-Now-Pay-Later (BPNL) industry is traversing a steep growth trajectory. A study by Kaleido Intelligence estimates that the BNPL market would grow from $89 billion in 2020 to $ 352 billion by 2025, a growth rate of almost 400 percent.

Global BNPL spending via e-commerce | Kaleido Intelligence

Additionally, it is expected that in 2025, $731 billion would be spent globally by utilizing the digital point of sale finance option, largely attributable to the surge in BNPL usage.

Effectively managing credit risks is the secret sauce to success for any BNPL player. Being an unsecured credit product, its success lies in the ability to control credit risk by leveraging upon data intelligence and cutting-edge technology tools to derive deep insights for prudent credit decision-making.

A BNPL provider’s technology stack has to be robust and advanced and have core systems built on polyglot microservices.

For years now, e-commerce and retail players have been strategizing to target the digital native population to drive growth. This largely comprises Gen Z’s and Millennials who have the purchasing power, yet are sceptical of using credit cards due to high interests and fees.

On the brighter side most of these credit sceptics who use Buy Now Pay Later, have begun to understand that BNPL is the fastest and most convenient mode of financing their purchases. Especially, when regular payments and transactions have high chances of failing quite often. There is also a greater realisation that BNPL may be improving the cash flow of the customer’s finances with no added cost.

For complete credit decisions, BNPL players must harness Machine Learning capabilities. This has dual advantages of eliminating human bias with an accurate assessment of the creditworthiness of the end-customers.

When a user attempts to check out using the payment platform, as a provider you need to make two key decisions – firstly, whether we should allow the user to transact and secondly, how much credit limit should you allocate to this user.

A provider can achieve this by simulating and processing 100+ features including the behaviour of the user on the merchant platforms, the behaviour of similar users with an analysis of historical patterns, signals from app installations, and run them through an ensemble model which is a combination of decision trees, gradient boosting, Bernoulli Naïve Bayes classifiers and simple logistic regression.

To prevent fraud transactions, repurposed time series prediction models are utlilized along with value-added functionalities to identify suspicious transactions and exceptions.

Deep integration with merchants goes a long way, especially with merchants who adopt BNPL as a payment option to their loyal and best customers, helping maintain the trust existing between merchants and customers to strengthen their mutual relationship. Work to deliver a superior user experience that surpasses all other current payment options, both from a consumer and merchant perspective, towards achieving deeper engagement levels.

As a step towards building an ecosystem that is based on the bedrock of trust, BNPL integrates tech-driven data analytics functions as an efficient mechanism towards controlling credit risks. This translates into a superior user experience as merchants are able to offer consumers convenience and safety at checkout; affordability when required and loyalty rewards that they deserve.

(Nitya Sharma, Co- Founder and CEO of Simpl-payments platform)