No details of how the money will be raised bothers market

Mumbai

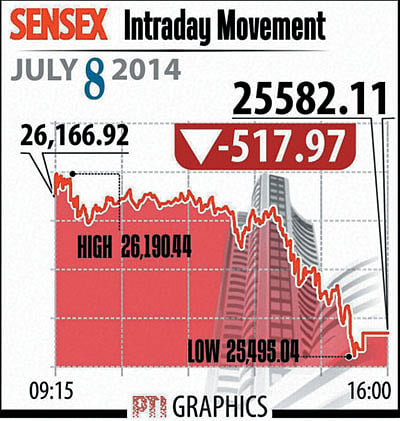

Prime Minister Narendra Modi’s government disappointed markets with its first major economic policy statement on Tuesday, promising to seek foreign and private funding for the railways but giving no details of how it would lure investors. Stocks fell sharply following the minister’s speech, with the Sensex closing down 2 percent. Investors had nursed expectations of Modi’s government using the railways budget to kick-start widespread reform. “The bulk of our future projects will be… by the PPP model,” Railway Minister Sadananda Gowda told Parliament while referring to public-private partnerships. He also promised to seek cabinet approval for foreign direct investment. But all this was short on details of how the wider goals would be met and how Gowda would get foreign companies such as Bombardier and General Electric to invest.

A part of the problem is that railways cost the government around Rs. 30000 crore a year in subsidies; the railways also spend 94 percent of its revenues on operating costs, leaving next to nothing for investment.

The government has revised upwards planned spending to Rs. 65445 crore for the year ending March 2015, an increase of 1.8 percent over the interim budget prepared in February by the last government. It has calculated investment in the network through public-private partnerships in 2014/15 to total Rs. 6005 crore, reports wire agency Reuters.

‘‘There is nothing in this entire budget which tells you how they will make it attractive for private sector,” said Manish R. Sharma, executive director of capital projects and infrastructure at PwC India.

“Given that in the past PPP has not taken off in railways…it would be very important to see how they come up with implementable mechanisms which the private sector will buy,” he told the wire agency.