After the swearing-in of the third NDA government, with PM Narendra Modi steering the coalition ship for a third consecutive term, all eyes are now set on the full budget for FY25, which is expected to be presented by Finance Minister Nirmala Sitharaman.

Earlier, it was reported that the minister would be holding meetings with industry chambers before the budget. With 'business-as-usual' returning after the chaotic election season, many have expressed their expectations and demands from this full budget after the interim budget, which was presented earlier this year in February.

Bring Petroleum Under GST

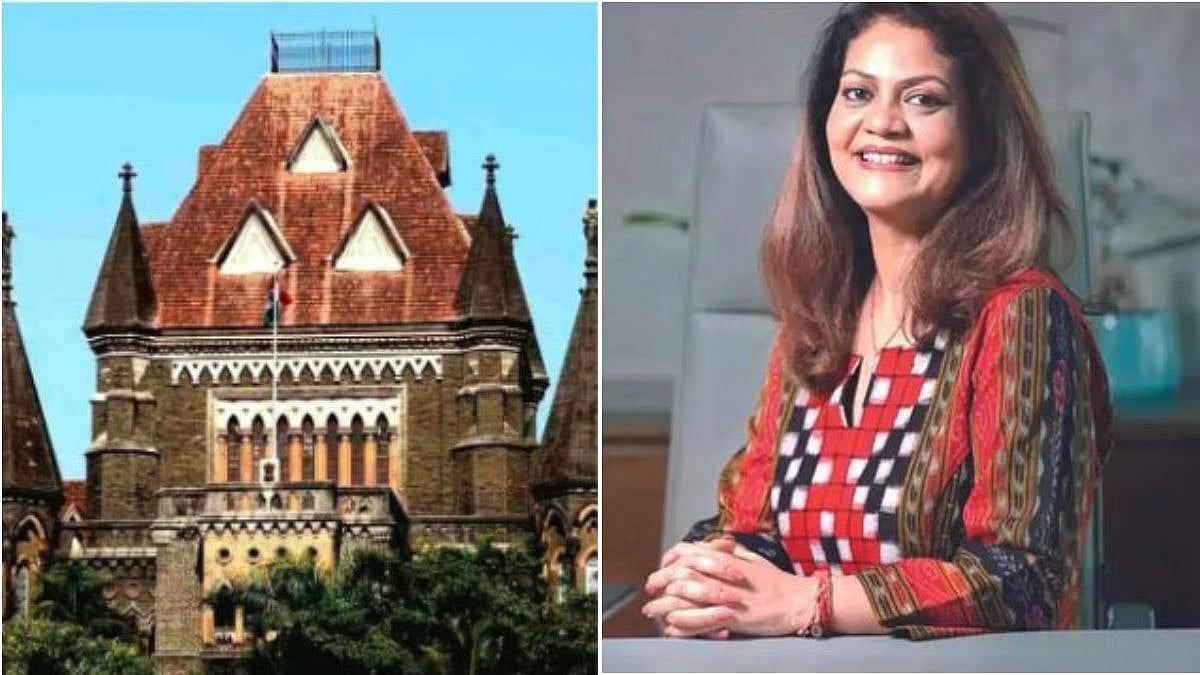

The head of one of the most important industry bodies, the Confederation of Indian Industry or CII, Sanjiv Puri, voiced his thoughts on the budget while speaking to CNBC TV18's Shereen Bhan.

One of the crucial elements that Puri touched upon in the interview was the common demand to bring petroleum and other petroleum-derived products under the GST regime. | Image: Wikipedia (Representative)

One of the crucial elements that Puri touched upon in the interview was the common demand to bring petroleum and other petroleum-derived products under the GST regime. This has been a demand of many in the industry, along with some opposition parties for years now.

Currently, petroleum products, especially Petrol and Diesel are subject to various other taxation systems, including central excise duty, central sales tax, and most importantly, VAT or Value-Added Tax, that is levied by each individual state, thereby availing the product at different rates in different states.

This is a politically and fiscally complicated paradigm, given how bringing crude products under GST would take away one of the last sources of direct income for the state government, and, in all likelihood, make them more dependent on the Centre.

Then Puri, Sanjiv Puri, who is also the Chairman and MD of ITC, talked about the reality sector in the Goods and Service Tax paradigm. |

Bring Reality Into GST

Then Puri, Sanjiv Puri, who is also the Chairman and MD of ITC, talked about the reality sector in the Goods and Service Tax paradigm.

He further focused on GST and also demanded the system be re-oriented into a 3-rate structure. Puri also spoke about inflation in the country and anticipated that inflation could be moderate if the monsoon, as predicted, would be normal or above normal. Due to an emerging La Nina phenomenon, greater rainfall is expected, which could affect agriculture and production positively. In all, Puri expressed his hope for an all-inclusive budget.

.jpg)