The Q3 results season is in full swing, as more companies are filing their quarterly results. One such company, Borosil Renewables, which published its results recently, saw its shares decline significantly, even hitting the lower circuit on Monday.

Borosil Bounces Back

This came to pass after the company's losses widened further in the third quarter of FY15.

The company's losses nearly doubled on a year-over-year basis. From Rs 15.90 crore in December of 2023, these losses increased to Rs 30 crore in the quarter that concluded on December 31, 2024.

When we take a closer look at the stocks in question, the company shares, as mentioned before, hit the lower circuit on Monday, February 17. The state of stock was a lot different on Tuesday, February 18, as the company shares rose significantly, going on to reverse the effect and hit the upper circuit. |

The Mumbai-registered company also exhibited weak operational performance.

In addition, the company recorded an EBITDA loss of Rs 1.1 crore in the latest quarter, compared to over RS 20 crore in the last fiscal.

When we take a closer look at the stocks in question, the company shares, as mentioned before, hit the lower circuit on Monday, February 17. The state of stock was a lot different on Tuesday, February 18, as the company shares rose significantly, going on to reverse the effect and hit the upper circuit.

Borosil Shares

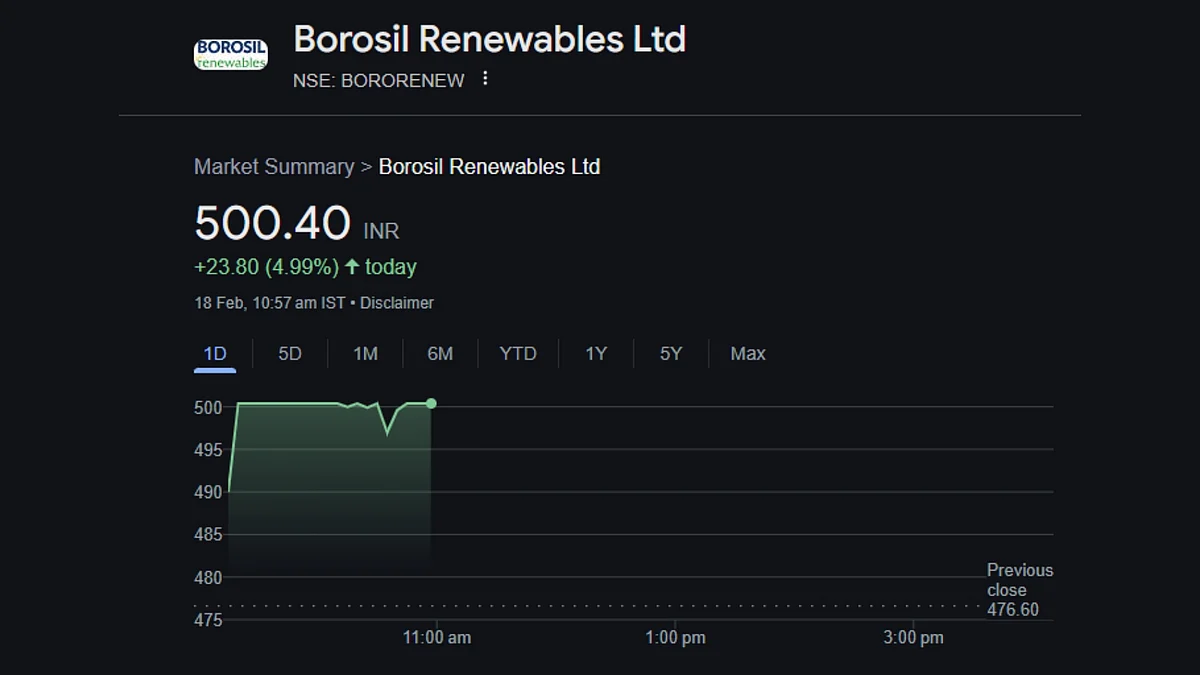

The company shares rocketed at the opening bell, as it started the day at Rs 490.90 per share, higher than its previous closing of Rs 476.60 per share.

As the day progressed further, the value of the share kept on growing. The shares hit the milestone Rs 500 mark, catapulting to Rs 500.40, thanks to gains of Rs 23.80 or 4.99 per cent.

When we look at the bigger picture, the company shares have not had a merry time at Dalal Street in the recent past.

Over the past month of trade, Borosil Renewables has seen its stock price shrink by around Rs 64.30 or 11.39 per cent. As we go further back in time, over the past 6 months of trade, the value of the company shares has declined by 2.97 per cent or Rs 15.30 per piece.