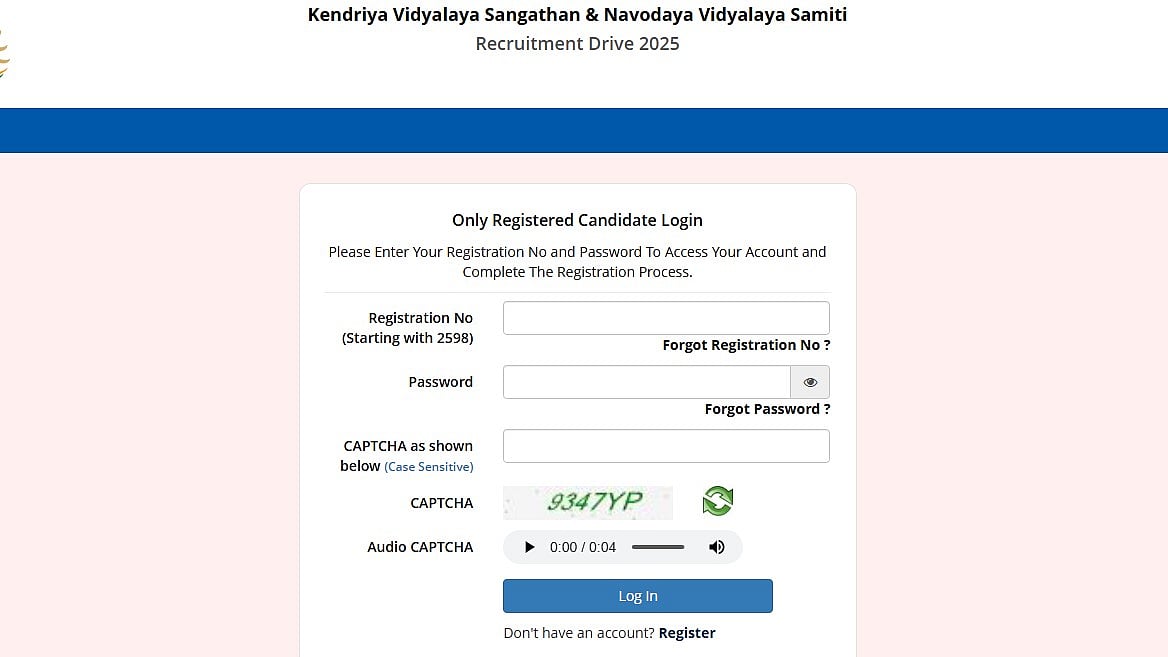

Mumbai: Reliance Jio Platforms is preparing to bring its much-awaited initial public offering (IPO) in India later this year. According to a Reuters report citing sources, the company is considering selling around 2.5 percent stake through the IPO. If this plan goes ahead, the listing could become the largest IPO ever in the Indian market.

The report said that Reliance Jio is working with investment banks Morgan Stanley and Kotak Mahindra Capital to prepare the IPO prospectus. Discussions are still ongoing, and final decisions are yet to be taken.

IPO Could Be Worth Over USD 4 Billion

Based on current estimates, selling a 2.5 percent stake could help Reliance Jio raise nearly USD 4.5 billion. This would be larger than Hyundai Motor India’s IPO last year, which raised USD 3.3 billion.

In November, global brokerage firm Jefferies valued Reliance Jio at around USD 180 billion. Some bankers believe the valuation could even be higher, between USD 200 billion and USD 240 billion. However, Reliance has not yet finalised the valuation for the IPO.

India’s Largest Telecom Company

Reliance Jio Platforms is the parent company of Reliance Jio, India’s largest telecom operator with over 500 million users. Over the past six years, the company has expanded rapidly and entered new areas such as artificial intelligence and digital services.

During this growth phase, Jio has raised funds from several large global investors, including KKR, General Atlantic, Silver Lake, and Abu Dhabi Investment Authority. These investments have strengthened Jio’s balance sheet and supported its expansion plans.

Why Only 2.5 percent Stake Is Planned?

Sources said that due to the company’s large size, Reliance Jio is planning to list only a small portion of its equity. The company prefers to sell just 2.5 percent of its shares instead of a larger stake.

However, current Indian regulations require a minimum public shareholding of 5 percent for large IPOs. The market regulator has proposed reducing this requirement to 2.5 percent, but the proposal is still awaiting approval from the finance ministry. If approved, it would clear the way for Jio’s planned listing structure.