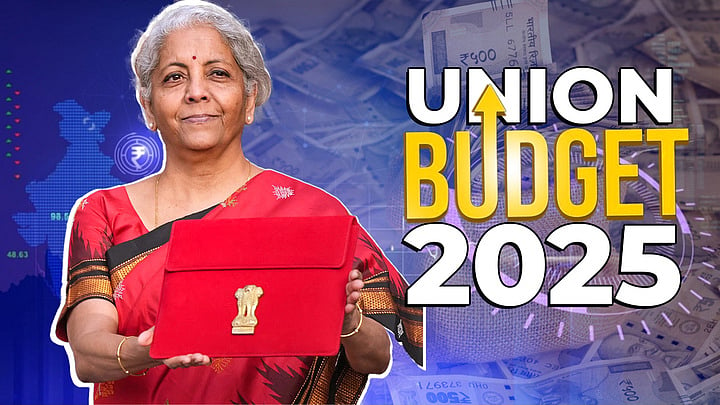

New Delhi: In a big relief of middle and salaried class people, Finance Minister Nirmala Sitharaman during her Union Budget 2025 speech, announced that there will be no income tax payable up to an income of Rs 12 lakh. Sitharaman said personal income tax reforms with special focus on middle-class. Democracy, demography and demand are the key support builders in a journey towards 'Viksit Bharat'.

“I propose to revise tax rate structures as follows: 0 to Rs 4 Lakhs - nil, Rs 4 Lakhs to Rs 8 Lakhs - 5%, Rs 8 Lakhs to Rs 12 Lakhs - 10%, Rs 12 Lakhs to Rs 16 Lakhs - 15%, Rs 16 Lakhs to Rs 20 Lakhs - 20%, Rs 20 Lakhs to Rs 24 Lakhs - 25% and above Rs 24 Lakhs - 30%. To taxpayers up to Rs 12 Lakhs of normal income other than special rate income such as capital gains, tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them,” Sitharaman announced.

The Union Finance Minister said tax proposals are guided by income tax reforms for middle class, TDS rationalisation, and easing compliance burden. The government will also be introducing a new Income Tax (I-T) bill in Parliament next week.

Reforms are not destinations but means to achieve good governance for the people and economy, the finance minister said and added that the new I-T bill will be half of the current volume, clear and direct in wording.

Meanwhile, the government will increase the limit of TCS on remittances under RBI's liberalised remittance scheme from Rs 7 lakh to Rs 10 lakh.

Sitharaman on Saturday announced her eighth consecutive budget.