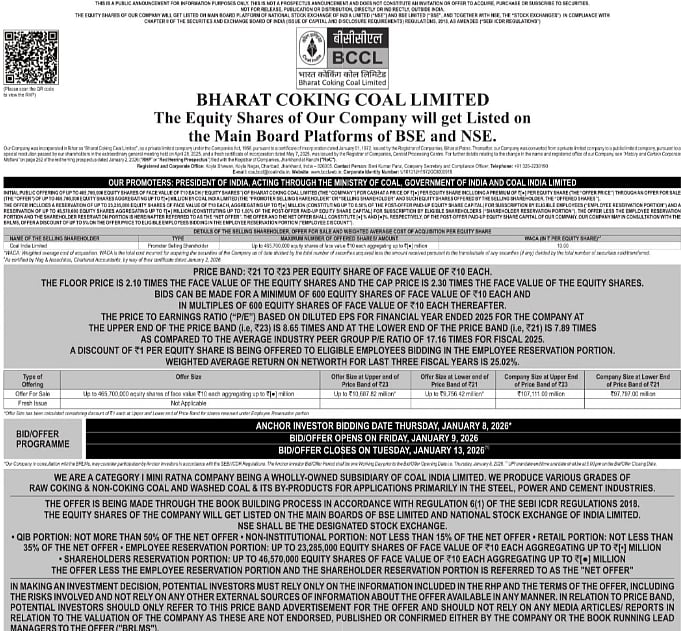

New Delhi: Bharat Coking Coal Ltd (BCCL), a wholly-owned subsidiary of Coal India Ltd, is set to open its initial public offering on January 9, marking the first public issue of 2026.

File Image |

The initial public offering (IPO) will be closely tracked by the Dalal Street as an early gauge of investor appetite for public sector undertakings (PSUs) in the new year. According to the red herring prospectus (RHP), the maiden public issue, entirely an offer for sale (OFS) of 46.57 crore equity shares by Coal India Ltd (CIL), will close on January 13, while anchor investor bidding is scheduled for January 8.

The proposed listing of BCCL is part of the government's broader divestment push in the coal sector, aimed at unlocking value in Coal India's subsidiaries and enhancing transparency through market discipline. The company will announce key details, such as price band, lot size and issue structure, on January 5.

Last year, Central Mine Planning and Design Institute Ltd (CMPDIL), another wholly-owned arm of CIL, had also filed its draft papers with Sebi for an IPO via the OFS route. While BCCL is a coal-producing entity, CMPDIL serves as Coal India's technical and planning arm. The timing of BCCL's issue comes against the backdrop of a blockbuster year for the primary market.

In 2025, companies raised a record nearly Rs 1.76 lakh crore through IPOs, buoyed by strong domestic liquidity, resilient investor sentiment and a supportive macroeconomic environment. This surpassed the Rs 1.6 lakh crore mobilised by 90 firms in 2024 and the Rs 49,436 crore raised by 57 companies in 2023.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.