In the ongoing parliament session of the 18th Lok Sabha, a member of parliament from Tiruvallur, Sasikanth Senthil of the Congress, enquired of the finance ministry to know more about the resources or loans disbursed under the centre's Mudra Scheme in the state of Tamil Nadu.

Rs 2.98 lakh Crore In Tamil Nadu

The Finance Ministry responded to the query and said, "As per data uploaded by Member Lending Institutions (MLIs) on the MUDRA portal, more than 5.54 crore loans amounting to Rs. 2.98 lakh crore have been sanctioned in the State of Tamil Nadu as on June, 2024, since the inception of the Scheme."

The ministry further added that the rate of interest in the case of loans disbursed has been deregulated by the RBI and is governed by the bank’s own lending policies. |

However, the ministry claimed that details of applications for the Pradhan Mantri Mudra Yojana (PMMY) are not centrally maintained.

The ministry further added that the rate of interest in the case of loans disbursed has been deregulated by the RBI and is governed by the bank’s own lending policies.

In addition, the interest rate charged for Mudra loans by government-owned banks ranges from 9.15 per cent -12.80 per cent. For Private Sector Banks, the rate ranges from 6.96 per cent -28 per cent. This is based on cost of funds, risk profile of the borrower, tenure of loans etc.

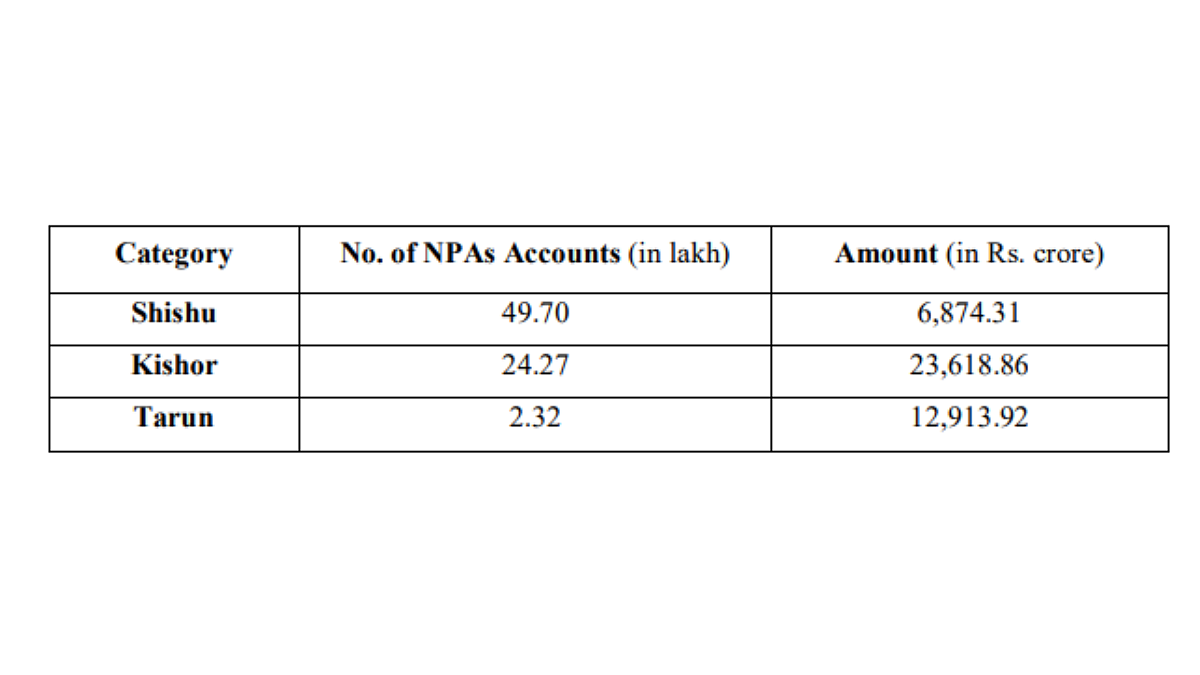

Loans That Turned Into NPAs

When it comes to the NPAs under the three categories of Shishu, Kishor and Tarun, the government claimed that as many as 76.29 lakh accounts amounting to Rs. 43,407.09 crore have turned into Non-Performing Assets.

The loans given under the Kishor category had the largest amount, with Rs 23,618.86 crore.