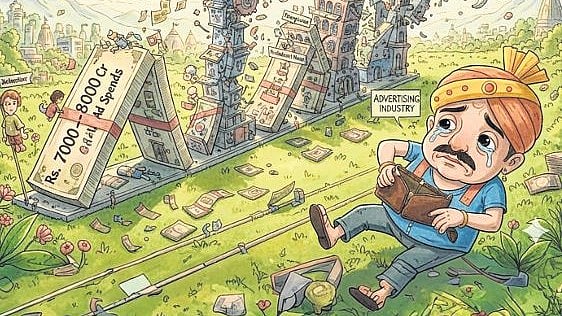

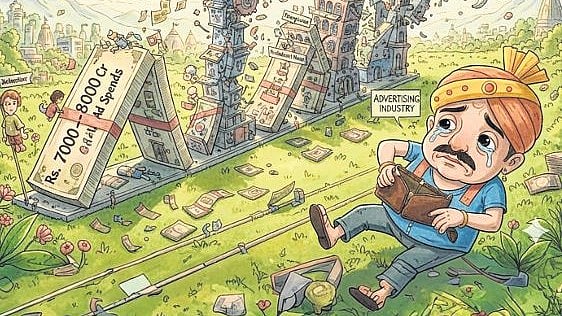

Trouble. Trauma. Tumult. Tears. Tension. All words (and sentiments) that describe Indian advertising in the year gone by. So this year-ender is not about famous brand campaigns or Cannes awards. It is about a year that saw the Indian advertising ecosystem suffer some massive body blows that will most likely continue to have repercussions in 2026, and beyond.

In the last week of March, the Competition Commission of India (CCI) conducted raids at leading media agencies, including Dentsu, Omnicom, Havas, Madison, IPG, GroupM, and Publicis, as well as industry bodies such as the Advertising Agencies Association of India (AAAI), the Indian Society of Advertisers (ISA), and the Indian Broadcasting and Digital Foundation (IBDF). These searches were carried out over allegations of media cartelisation, signalling heightened scrutiny on the sector.

The raids spanned multiple cities, including Mumbai, New Delhi, and Gurugram, and involved scrutiny of emails and other communications to uncover evidence of anti-competitive practices. The timing of these raids was particularly significant, occurring just before the commencement of the Indian Premier League (IPL) – a cricket tournament that attracts massive advertising budgets across TV, digital, and sponsorships. Disruption in media buying operations right before the tournament naturally, and inevitably, impacted negotiations and pricing. Most industry-wallahs blamed my erstwhile JV partners, Dentsu of Japan, for having triggered the probe because of an ill-thought leniency petition.

The probe continues. But the CCI raids have ended the years-long camaraderie between the AAAI, IBDF, INS and ISA, not counting the media agencies. At least for now. WhatsApp groups that were full of both business give-and-take, and brotherly bonhomie, have suddenly gone quiet. This was the first blow of the year.

Then in August came the Promotion and Regulation of Online Gaming Act. Shutters for real money gaming. And, who got affected? The platforms. Their owners. Their investors. Their employees. Their vendors. Also, their ad agencies. Their performance marketing agencies. Production houses who produced the visual assets. The celebrity endorsers. BCCI. IPL teams. The cricket broadcaster. Meta, Google, YouTube … all the carriers of digital ads and clicks. Estimated loss? In 2024 PwC estimated the total size of the Indian online gaming market to be Rs 33,000 crore in 2023 and had estimated it would reach Rs 66,000 crore, growing at a CAGR of 14.5% between 2023–2028. For advertising the gaming ban wiped out a minimum of Rs 7,000 to 8,000 crore in annual ad spends. It could have been more.

BCCI and IPL teams (jersey sponsorships mainly) lost about Rs 1,000–2,000 crore between them. JioStar and JioHotstar lost another Rs 1,000 crore or more from selling commercial time. Performance marketing saw a Rs 5,000+ crore erosion – it was a big category for them. Celebrities lost Rs 300–400 crore annually in endorsements. The ad agency business lost another Rs 300–400 crore in fees and retainers. Production houses got poorer by Rs 200–300 crore. The entire ad industry ecosystem was traumatized by the ban.

Dream 11 with revenues of Rs 6,380 crore spent Rs 2,960 crore on advertising, promotion and brand-building. Games 24x7 (owners of My11Circle and RummyCircle) earned Rs 1,990 in revenue and splurged a reported Rs 1,420 on promotions. Gameskraft, M-League, Winzo, Pokerbaazi, Zupee… and many others spent large sums too. All gone. This was the second big blow to advertising in 2025.

And then came the Omnicom-Interpublic merger in December. DDB Mudra gone. Mullen Lowe gone. FCB Ulka gone too. Lintas stayed alive in a hyphenated avatar but no one knows for how long. The media agencies got spared the scalpel. All legacy Omnicom and IPG entities were brought under a single “Omnicom Media” umbrella. Major brands like OMD, PHD, Hearts & Science (Omnicom) and Initiative, UM, Mediahub (IPG) continue to exist but will operate within this larger structure. IPG’s data arm, Acxiom, also got integrated into Omnicom Media, alongside Omnicom’s tech platform, Omni.

On the face of it, the reconfiguration is complete. But the bloodshed, everyone knows, has just about started. Estimates vary but 2,000–3,000 jobs are on the chopping block immediately. The number could swell to double that by the time the dust settles fully. That was the third big blow of the year.

The fourth big blow of the year was the departure of some really tall stalwarts of Indian advertising. Diwan Arun Nanda of Rediffusion. Piyush Pandey of Ogilvy. Ram Sehgal of Contract. It made for lots of obituaries, tributes and trips down memory lane for brands and the reliving of many famous campaigns. Copious tears were shed in the memory of the greats.

The one big news that was awaited all year – the sale of Madison – didn’t finally come through. There were media reports, there were conjectures that the deal was ‘almost’ signed and sealed. But the deal eventually never got delivered. Maybe 2026?

And now to the elephant that entered the room in 2025 and sparked more anxiety and debate than any other happening through the year. Artificial Intelligence (AI). A large number of brands started to move from traditional ad films to vertical digital content for social media, often using AI. But most ad agencies did not see the shift as an opportunity – they saw it as the death knell of legacy advertising and traditional structures.

AI in 2025 was no longer a novelty. It became a tool and technology very few really understood, but all knew that it was a force that would soon reshape and redefine the advertising landscape in India. For now there is still disbelief amongst some, fear in most others. Reskilling or upskilling sounds nice and progressive, but is very difficult to drive in organisations so conditioned to the past.

Can there be a year-ender on advertising without ad campaigns? Honestly, yes. Trouble. Trauma. Tumult. Tears. Tension. They ruled Indian advertising in 2025. The bad news kind of continued through the year, sending the advertising business reeling. And this is minus the impact that AI has just started to have.

We laugh, we weep, we hope, we fear,

And that’s the burden of a year.

One hopes 2026 will bring better tidings.

-- Dr. Sandeep Goyal

The author is an advertising and media veteran. He is Chairman of Rediffusion and also Consulting Editor of The Free Press Journal.