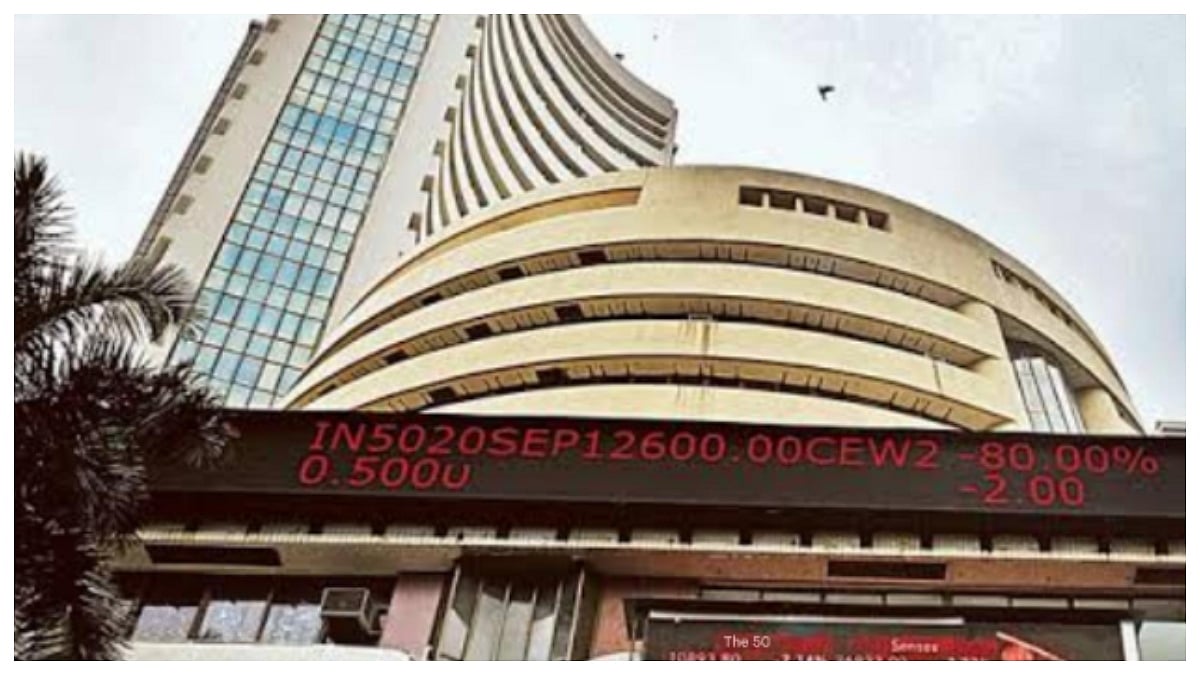

Sensex Today: Markets Tumble ₹2.6 Lakh Crore, FII Selling & Weak Global Cues Trigger Sharp Stock Slide

Indian markets fell sharply on Tuesday, losing Rs 2.6 lakh crore due to continuous FII selling, weak global cues, IT sector pressure, and profit booking, while consumer durables remained strong.

Indian stock markets fell for the third day. | Markets Close in Red After Sharp Sell-Off.

Mumbai: The Indian stock market ended sharply lower as selling pressure dominated throughout the day, on Tuesday. Persistent FII selling, weak global cues, and sector-wise profit booking weighed on investor sentiment. The Sensex dropped 519 points to close at 83,459, while the Nifty slipped 166 points to 25,597. Banking, IT, metals, and auto stocks faced heavy losses, with only the consumer durables index closing in green.

Out of Nifty 50 stocks, 40 closed in the red. Market breadth was weak, with an advance-decline ratio of 1:2, meaning decliners outnumbered gainers two to one. Nifty Bank fell 274 points to 57,827, and the Midcap Index dropped 250 points to 60,037.

Foreign Investors Continue Selling

A key reason for the market weakness was continued selling by foreign institutional investors (FIIs). On Monday alone, FIIs sold Rs 1,883 crore worth of shares, marking the fourth consecutive day of FII outflows since October 29. Over four sessions, FIIs have offloaded Rs 14,269 crore in Indian equities.

Shrikant Chouhan, Head Equity Research at Kotak Securities, says today benchmark indices faced significant selling pressure, with Nifty closing 166 points lower and Sensex down 519 points. Most major sectoral indices were under pressure, while Defence, Capital Market, and Metal indices fell around 1.5 percent. Technically, intraday charts show a lower top formation, and daily charts have formed a bearish candle, signaling potential further downside.

ALSO READ

Chouhan adds that as long as the market remains below 25,700/83,750, weak sentiment is likely to persist. On the downside, Nifty could test 25,550/83,300, and further weakness may push levels to 25,450–25,400/83,000–82,800. Conversely, a break above 25,700/83,750 could trigger a bounce back toward 25,800/84,100 and 25,875/84,400.

Weak Global Cues

Asian markets also faced profit booking, with South Korea’s Kospi, Japan’s Nikkei 225, and China’s Shanghai Composite closing lower. U.S. futures fell nearly 1 percent, signaling a weak start for Wall Street. Combined pressure from global weakness and foreign selling dragged Indian markets down.

Profit Booking and Sectoral Pressure

Recent gains from corporate tax cuts and earnings optimism led investors to book profits. According to Sandeep Raichura of Prabhudas Lilladher, “The mild decline is largely profit booking. The domestic equity foundation remains strong, but investors await Q3 results and global trade signals.' Weak IT earnings also contributed, as TCS and Infosys dropped around 1 percent, adding pressure to the IT index.

Derivatives Expiry Impact

Ahead of the Nifty weekly expiry, traders rolled over positions, increasing market volatility. Analysts note this as part of normal technical fluctuations.

RECENT STORIES

-

-

-

-

-