Term Insurance for NRI: Everything You Need To Know

Are you among those NRIs eyeing term insurance plans from India, perhaps because options abroad seem pricey or less appealing?

With over 13 million Non-Residential Indians (NRIs) scattered around the globe, the quest for securing a slice of home in the form of term insurance has become more relevant than ever before. Are you among those NRIs eyeing term insurance plans from India, perhaps because options abroad seem pricey or less appealing? The landscape of term insurance for NRIs might seem complex, but it's quite accessible and beneficial once you navigate through its intricacies.

We are here to simplify the maze of term life insurance for you. Without selling any products or harbouring biases for commissions, we aim to guide you toward making informed decisions, backed by a strong legacy and expertise.

What is Term Insurance for NRI?

Term insurance for NRIs is essentially a life insurance policy that provides coverage at a fixed rate of payment for a limited period. After the term expires, coverage at the previous rate of premiums is no longer guaranteed, and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. If the insured dies during the term, the death benefit will be paid to the beneficiary.

Who is Eligible to Buy Term Insurance for NRI in India?

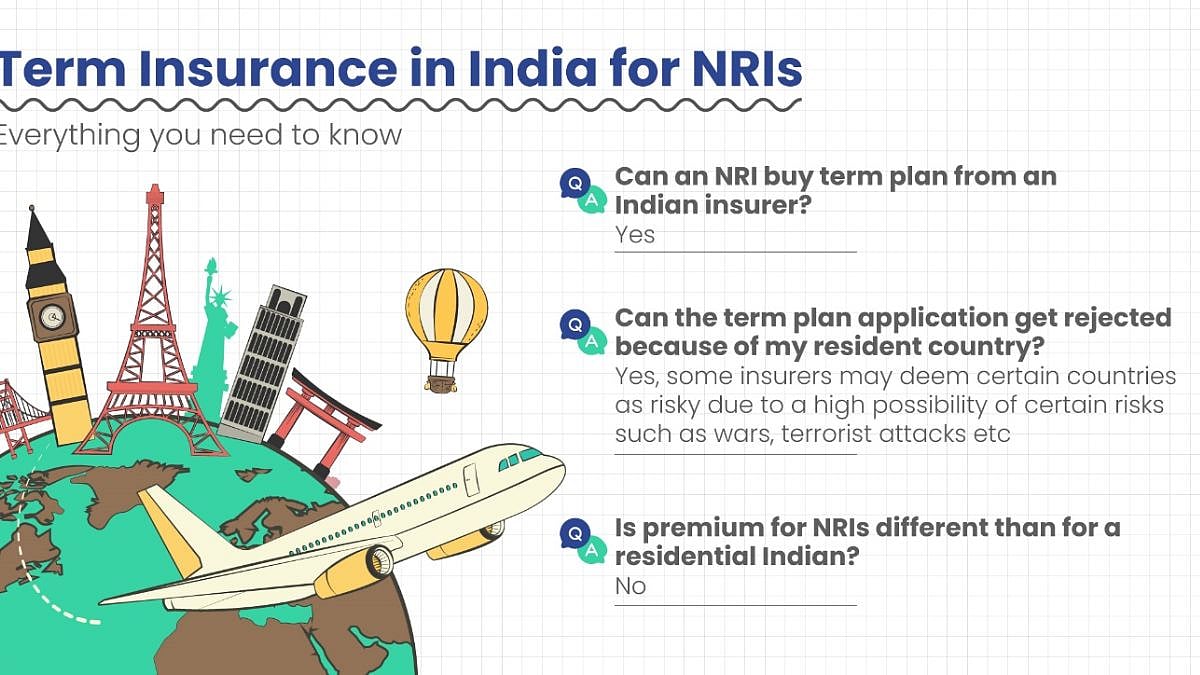

Eligibility for NRIs to buy term insurance in India hinges on a few criteria. NRIs can purchase term insurance while visiting India or even from their resident country, provided they disclose their country of residence and complete the necessary formalities. However, checking with insurers is crucial as some may have restrictions based on the applicant's resident country.

Features of Term Insurance for NRIs

Term insurance for NRIs reveals a treasure trove of features designed to meet the unique needs of those living abroad yet wanting to ensure their family's financial security back home. These features cater to the practical aspects of managing insurance from overseas and offer peace of mind knowing that distance does not diminish the safety net you can provide for your loved ones. Here are some of the standout features that make term insurance for NRIs a wise choice:

Flexibility in Purchase: Buy it while in India or from your resident country.

Payment Through NRE/NRO Accounts: Premiums can be paid via Non-Resident Ordinary (NRO) or Non-Resident External (NRE) accounts.

Similar Premiums to Residents: The insurer assesses the risk similarly to that of an Indian citizen.

Dedicated NRI Desks: Some insurers offer specialised desks to cater to NRI customers.

How do Term Insurance Plans for NRI Work?

Navigating the process of securing insurance for NRIs may seem daunting, involving tasks like mail orders, notarization, and verifications from Indian diplomats. However, at its core, the process is straightforward. Whether obtaining a policy from within India or abroad, premiums are often comparable to those for Indian citizens, provided the risk assessment aligns.

Essential Documents and Costs for NRIs Buying Term Insurance in India

When you, as a Non-Residential Indian (NRI), decide to root your financial safety in Indian soil through term insurance, there are a few key things you’ll need to navigate. The process, although straightforward, requires certain documents and an understanding of the costs involved:

ID Proof: A valid passport usually suffices, ensuring your insurer knows you're the genuine article.

Address Proof: Where you call 'home' abroad needs to be established. It could be as simple as a utility bill or a lease agreement.

Age Proof: A document that confirms your date of birth, because age is more than just a number in insurance.

Income Proof: To gauge the insurance coverage you can afford, your earnings need to be transparent.

Medical Proof: An important puzzle piece that assesses your health status and decides your premium.

Photographs: A snapshot for identification purposes.

Tax Implications to Consider

Another critical aspect to ponder over is the tax benefits, which will depend on the prevailing laws of your resident country. The fiscal perks, like free medical tests, that make term insurance plans appealing in India might not translate universally, so a little bit of homework can go a long way.

Benefits of Term Insurance for NRIs

The advantages of securing term insurance as an NRI are manifold:

Financial Security for Loved Ones: Ensures your family's financial stability in your absence.

Affordability: Often more cost-effective compared to similar plans in foreign countries.

Ease of Payment: Premiums can be easily paid through NRE/NRO accounts.

Peace of Mind: Offers a sense of security knowing a policy from homeground covers you.

Term plan for NRIs is not just a financial product or plan but a bridge to connecting with your roots while ensuring your loved ones are secure, no matter where you are in the world. We are here to guide you through this journey, emphasising clarity, simplicity, and unbiased advice.

Whether you are ready to dive into the details of term insurance or still navigating your options, we have got you covered, not to sell you on it. Because for NRIs seeking the best term insurance plan, comprehensive knowledge is invaluable. If you are seeking clarity on choosing a term insurance plan, here's a free tool that offers a detailed term policy guide.

Published on: Saturday, April 06, 2024, 03:11 PM ISTRECENT STORIES

-

-

-

-

-