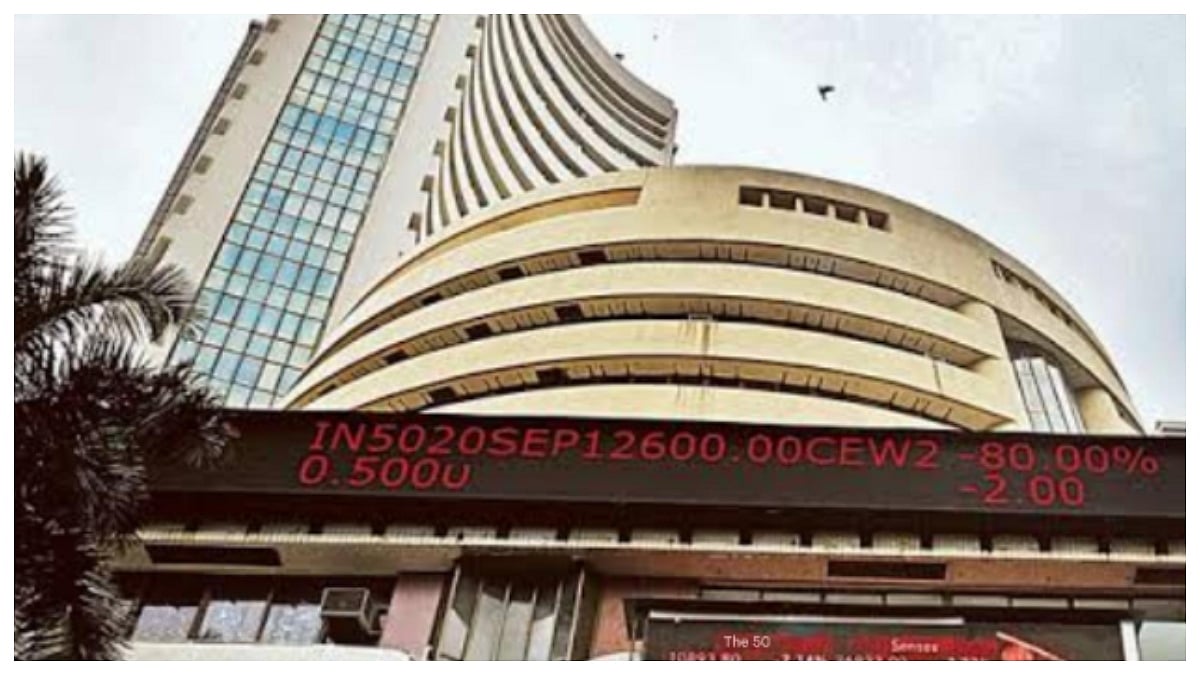

Sensex, Nifty End Slightly Lower In Thin Year-End Trade, Foreign Fund Selling Weighs On Markets

Indian stock markets closed marginally lower amid thin year-end trading and continued foreign fund outflows. The Sensex fell 20 points, while the Nifty ended almost flat. Mixed global cues and lack of strong triggers kept investors cautious, with FIIs remaining net sellers despite support from domestic institutions.

Markets slip amid low year-end activity. |

Mumbai: Indian stock markets closed marginally lower on Tuesday as thin year-end trading volumes and continued foreign investor selling dampened sentiment. Investors remained cautious amid mixed global cues, leading to limited movement in benchmark indices throughout the session.

The subdued trading reflected a lack of strong triggers, with many market participants staying on the sidelines ahead of the year-end.

Sensex and Nifty close almost flat

The BSE Sensex slipped for the fifth straight session, ending 20.46 points or 0.02 percent lower at 84,675.08. During the day, the index moved within a narrow range, touching a high of 84,806.99 and a low of 84,470.94.

The NSE Nifty 50 also ended nearly flat, falling 3.25 points or 0.01 percent to settle at 25,938.85. Both indices struggled to find direction as buying interest remained muted.

Stock-specific action in focus

Among Sensex stocks, Eternal, Infosys, Asian Paints, UltraTech Cement, Bajaj Finance, HCL Technologies and Titan were among the top losers, weighing on the index.

On the positive side, Tata Steel, Mahindra & Mahindra, Bajaj Finserv and Axis Bank managed to post gains, offering some support to the benchmarks and limiting deeper losses.

Mixed global market cues

Asian markets showed mixed trends. Hong Kong’s Hang Seng index ended in the green, while Japan’s Nikkei 225, South Korea’s Kospi and China’s Shanghai Composite closed lower. European markets were trading marginally higher during Indian market hours.

US stock markets ended lower on Monday, adding to cautious sentiment among global investors.

ALSO READ

Foreign flows and crude oil

Foreign Institutional Investors (FIIs) continued to sell Indian equities, offloading shares worth Rs 2,759.89 crore on Monday. In contrast, Domestic Institutional Investors (DIIs) provided support by buying stocks worth Rs 2,643.85 crore, exchange data showed.

Meanwhile, Brent crude oil prices rose 0.47 percent to $62.23 per barrel, reflecting mild strength in global oil markets.

Previous session performance

On Monday, the Sensex had fallen 345.91 points to close at 84,695.54, while the Nifty declined 100.20 points to 25,942.10, extending the weak trend into Tuesday’s session.

RECENT STORIES

-

-

-

-

-