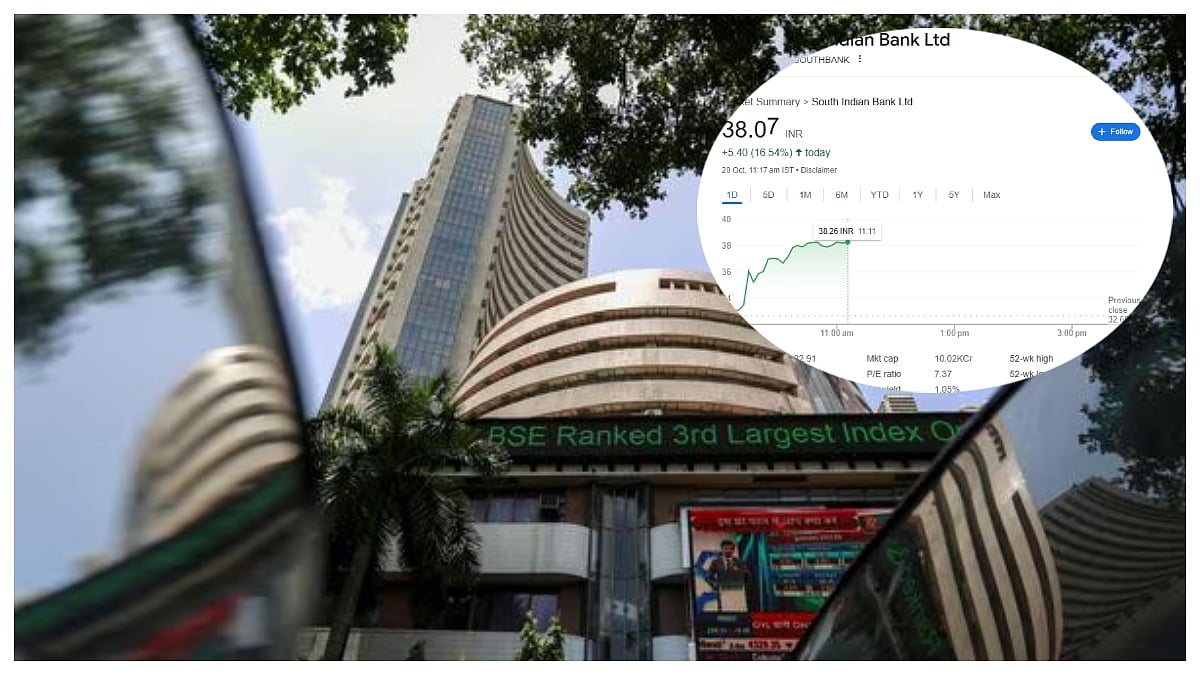

South Indian Bank Soars 17.18% On Strong Q2, Private Banks Rally As RBL Stake Sale Boosts Sentiment

South Indian Bank surged over 17 percent on strong Q2 results and improved outlook. Broader rally in private banks driven by earnings strength, RBL’s stake sale to Emirates NBD, and investor confidence.

South Indian Bank Leads the Rally. |

Mumbai: South Indian Bank’s stock soared 17.18 percent in intra-day trade on Monday, touching a 52-week high of Rs 36.25 on the BSE, amid a sharp rally in mid-sized private sector banks. The surge came after the bank posted encouraging earnings for the July-September quarter (Q2FY26), coupled with improved asset quality and a realignment of its loan book toward retail and MSME segments. Investors responded positively to the bank’s strategy and future growth outlook.

Brokerage firm ICICI Securities remains bullish on the stock, maintaining a ‘buy’ rating with a target price of Rs 38. They estimate that advances will grow at 11–12 percent CAGR over FY26–27, and project a return on assets (RoA) of around 0.9 percent by FY27. The bank's steady execution and resilience in asset quality have placed it in a strong position for margin recovery and profitability in the coming quarters.

Broader Bank Rally on Strong Q2 Earnings

The rally wasn’t limited to South Indian Bank alone. DCB Bank rose 13 percent to Rs 146 after reporting a strong set of Q2 numbers, supported by lower provisions, healthy net interest income, and improving margins. The bank’s asset quality showed improvement with moderated slippages, and management expects credit costs to remain below 45 basis points for FY26.

AU Small Finance Bank gained 8 percent to Rs 856.70, Federal Bank rose 5 percent to Rs 223.75, and RBL Bank added 5 percent to trade at Rs 314.65 — with many hitting 52-week highs. Federal Bank’s results highlighted margin recovery and improved asset quality, with Net Interest Margin expanding 12 basis points sequentially, and Gross NPA falling to 1.83 percent.

RBL Bank Stake Sale Fuels Market Optimism

Adding to the upbeat mood was news of a significant FDI deal involving RBL Bank. Emirates NBD, the Dubai-based banking group, plans to acquire a 60 percent stake in RBL via a $3 billion primary infusion — the largest foreign direct investment in India’s banking sector. The deal values the bank attractively and signals confidence in its long-term potential.

This strategic partnership is expected to strengthen RBL’s capital base, boost growth across retail and cross-border banking, and expand the bank’s access to global technology and expertise. The deal is subject to regulatory and shareholder approvals.

Motilal Oswal Financial Services continues to rate RBL Bank a ‘buy’, with a target price of Rs 350, citing strong potential for organic and inorganic growth supported by capital inflow.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Readers should consult financial experts before making any investment decisions based on market movements or analysis.

RECENT STORIES

-

-

-

-

-