Stock Market Outlook: Q1 Earnings & Global Cues In Focus, India-US Trade Talks Outcome May Move Markets

Stock market sentiment this week will hinge on key Q1 earnings, outcome of India-US trade talks, and global signals, as investors await clarity on economic policies, FII flows, and inflation outlook.

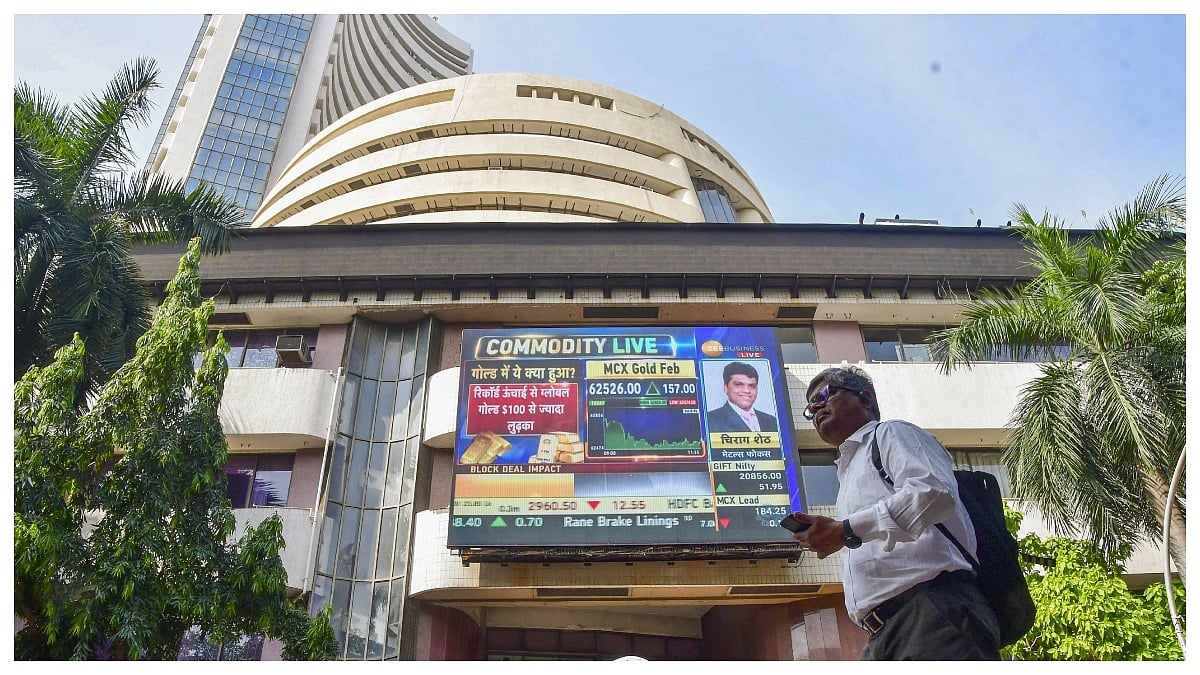

Markets on Edge: Q1 Results, Trade Talks to Steer Direction This Week. |

New Delhi: The Indian stock market is expected to remain highly sensitive this week to a combination of domestic and global factors, led by the quarterly earnings of major companies and the outcome of India-US trade discussions.

Heavyweight Earnings Set the Tone

The week started with investor focus locked on the Q1 results of key blue-chip firms such as Reliance Industries, HDFC Bank, and ICICI Bank, whose announcements came over the weekend.

Reliance Industries reported a record-breaking net profit of Rs 26,994 crore for the June 2025 quarter — its highest ever — showing a strong 78.3 percent year-on-year growth, primarily driven by its consumer business and investment-related gains.

ICICI Bank saw a 15.9 percent jump in consolidated net profit to Rs 13,558 crore, while HDFC Bank reported a 1.31 percent decline to Rs 16,258 crore in consolidated earnings. These numbers are expected to drive early trade reactions on Monday.

According to Ajit Mishra, SVP – Research at Religare Broking, “All eyes will be on the earnings season, as heavyweight companies continue to report. Apart from Reliance, HDFC Bank, and ICICI Bank, upcoming results from Infosys, Bajaj Finance, Dr Reddy's Laboratories, and Nestle India will be key drivers of investor sentiment.”

India-US Trade Talks in Spotlight

Adding to the domestic earnings buzz is the outcome of the recently concluded fifth round of India-US trade talks, which took place from July 14–17 in Washington. These discussions are particularly important as both nations aim to finalize an interim bilateral trade agreement (BTA) before August 1, when the suspension of the Trump-era tariffs on Indian goods (up to 26%) ends.

Siddhartha Khemka, Head – Research at Motilal Oswal, highlighted that the uncertainty surrounding the trade deal is causing investor caution: “The prolonged wait for a resolution is making investors hesitant, especially with the tariff deadline looming.”

Other Market Drivers: FII Activity, Global Cues

Beyond earnings and trade developments, investors will also track the foreign institutional investor (FII) flow, crude oil prices, and global market movements. Analysts are closely watching the evolving stance of the US Federal Reserve, especially regarding rate cut expectations, as inflation remains sticky in several major economies.

Pravesh Gour of Swastika Investmart added, “The market will stay active with both domestic and global cues at play. Investors should be alert to Q1 earnings from major names and any updates on trade policy decisions.”

Last Week’s Performance

The market ended on a weak note last week with the BSE Sensex falling by 742.74 points (0.90 percent) and the Nifty shedding 181.45 points (0.72 percent), reflecting nervousness ahead of key data and events.

(With PTI Inputs)

RECENT STORIES

-

-

-

-

-