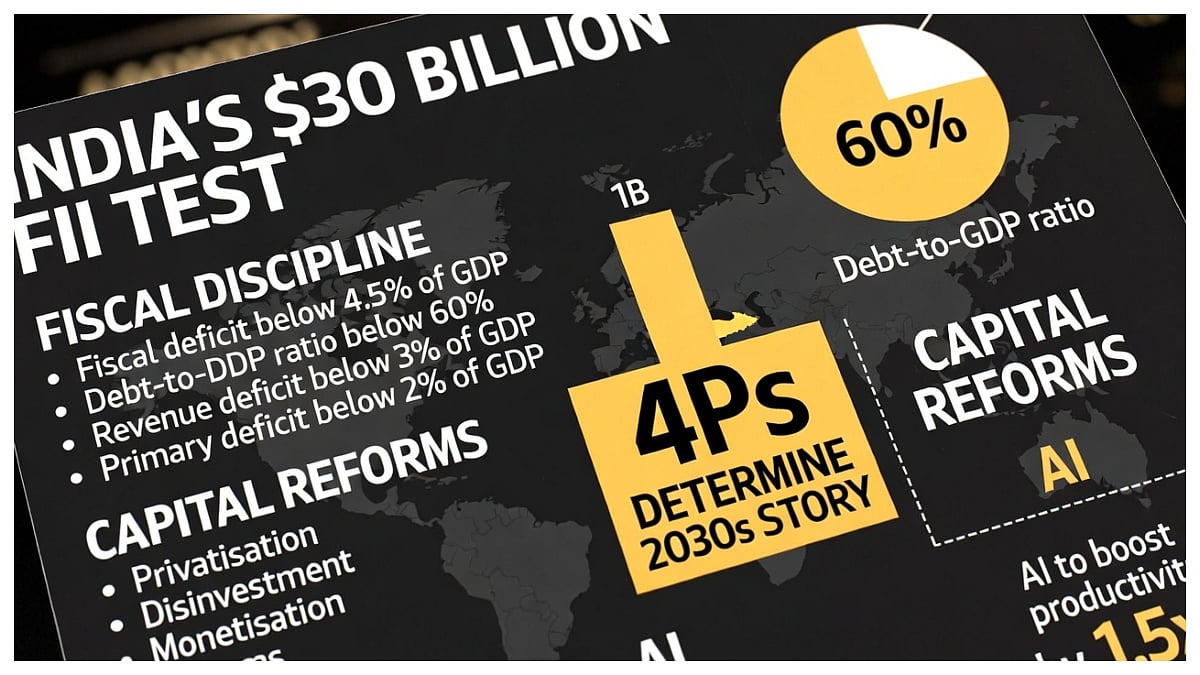

India’s $30 Billion FII Test And 60% Debt-To-GDP Discipline, Why AI, Capital Reforms & The 4Ps Will Decide The 2030s Story?

India’s resilience, fiscal discipline and reform momentum make it a compelling long-term investment case. However, AI leadership and urgent action on population trends, pollution, water stress and productivity will determine whether the 2030s deliver sustained growth or stagnation.

India’s resilience, fiscal discipline and reform momentum make it a compelling long-term investment case. |

Mumbai: At a time when global capital is cautious, supply chains are shifting and technology is redrawing competitive lines, India stands at a defining moment. The country has demonstrated macro resilience, fiscal discipline and reform momentum even amid global shocks. Yet the next decade will not be shaped by stability alone. Artificial intelligence, demographic shifts, environmental stress and productivity gains will determine whether India becomes a structural global growth story-or faces avoidable headwinds in the 2030s.

The India Pitch to Global Capital

If I were speaking to global FIIs, I would begin with resilience. Over the past two years, foreign investors pulled out nearly USD 30 billion from Indian equities, yet the system did not wobble. There were no capital controls, no emergency restrictions and no policy panic. The macro framework held firm, FX reserves stayed comfortable and continuity was preserved. That stability sends a powerful signal.

ALSO READ

India chose fiscal consolidation after COVID while many economies expanded deficits. The glide path toward a 4 percent-plus fiscal deficit by FY27 reflects discipline without sacrificing growth. Government capital expenditure has consistently crossed Rs 10 lakh crore annually, targeting roads, railways, ports, defence and logistics - investments that raise productivity rather than inflate consumption.

With public debt near 60 percent of GDP and a stated goal of moving toward 50% by 2030, India’s sovereign balance sheet is strengthening relative to many large peers. At the same time, inflation has remained moderate, giving policymakers room to manoeuvre.

ALSO READ

Structural reforms underpin this story. The Insolvency and Bankruptcy Code has improved credit culture. GST collections have doubled in five years, reflecting deeper formalisation. The digital public infrastructure, especially UPI, has transformed payments and transparency. Meanwhile, Production Linked Incentive schemes are pushing manufacturing scale.

The AI Inflection Point

Voices like Vishal Sikka argue that India’s next leap depends on owning AI capabilities rather than renting them. He has consistently warned that labour-arbitrage models in IT must evolve into “Labour + AI” arbitrage, with proprietary platforms and foundation models built in India. His engagement with policymakers and corporate leaders reflects a belief that AI is a strategic imperative, not a luxury.

ALSO READ

The 4Ps Risk

Yet risks loom: premature population ageing, severe pollution, falling per-capita water availability and stagnant productivity. Ignoring these “4Ps” while celebrating GDP growth could create a slowdown in the 2030s.

India today is a structural allocation story -but sustaining it will require prioritising productivity, water security and clean growth alongside AI leadership.

RECENT STORIES

-

-

-

-

-