Adani Makes First Filing In US Court, Signals Talks With SEC Over Fraud Charges

The Adani Group has made its first filing in a US court, showing readiness to discuss summons service with the SEC. The case relates to alleged securities fraud in a bond issue. India earlier refused to serve the summons, leading the SEC to seek alternative legal routes.

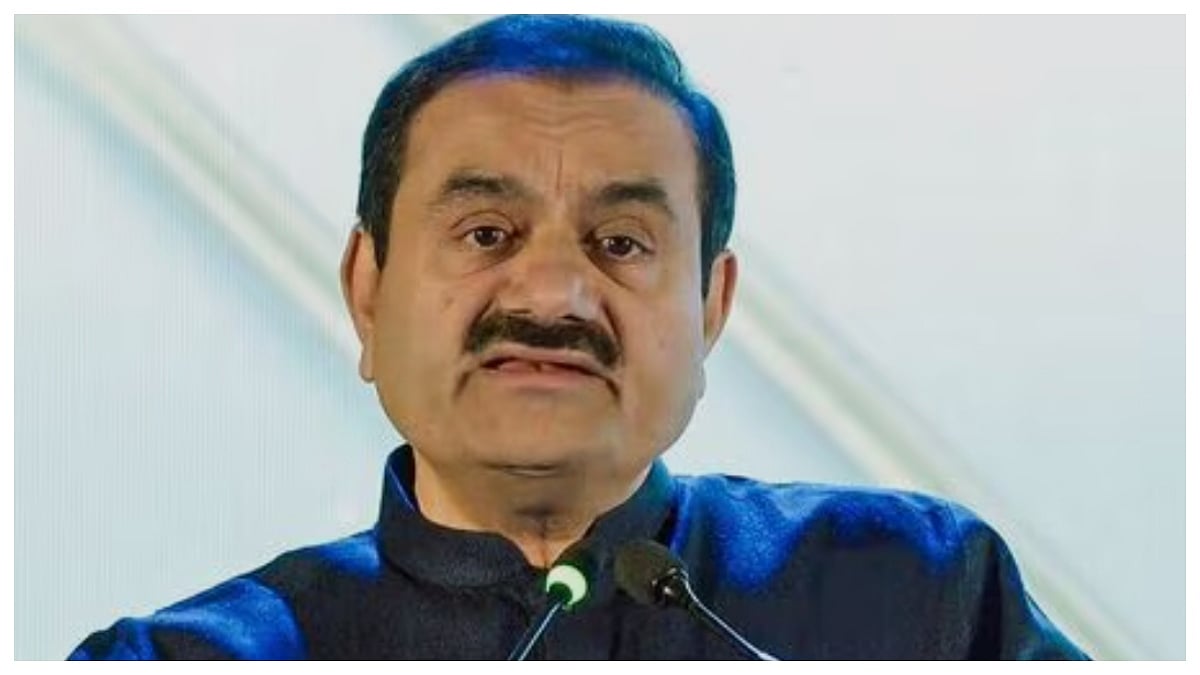

The Adani Group has made its first filing in a US court, showing readiness to discuss summons service with the SEC. | File Image |

Washington: Fourteen months after US regulators filed fraud charges, Gautam Adani and his nephew Sagar Adani have made their first formal filing in a US court, indicating a willingness to discuss how legal summons will be served. The move comes after the Indian government earlier refused twice to deliver the summons on behalf of US authorities.

What the filing says

In a letter dated January 23 to a New York federal judge, lawyers representing the Adanis said they are in talks with the US Securities and Exchange Commission (SEC) to resolve the issue of serving summons. They requested the court to pause its decision while discussions continue. However, the filing does not mention any settlement terms.

Background of the SEC case

The SEC filed civil fraud charges on November 20, 2024, alleging that the Adanis were involved in securities fraud linked to a USD 750 million bond issue that raised over USD 175 million from US investors. The Adani Group has strongly denied the allegations and described them as “baseless.”

India government’s objections

The Indian Ministry of Law and Justice earlier refused to serve the summons, citing missing signatures and official seals on documents sent under the Hague Convention, which governs international legal cooperation. Later, the ministry argued that the summons did not fall under the required legal categories.

SEC rejects India’s reasoning

The SEC rejected India’s objections, stating that the Hague Convention does not require signatures or seals on such requests. The regulator said it regularly sends similar requests to other countries, and they are usually accepted without objections.

Push to serve summons directly

After India’s refusal, the SEC asked the US court to allow the summons to be served directly through email and American lawyers, bypassing the Indian government. The SEC said Indian law does not offer any alternative way to complete the process.

Market reaction

Following reports of the SEC’s move, Adani Group shares fell sharply, dropping between 3.4 percent and 14.54 percent on Friday.

RECENT STORIES

-

-

-

-

-