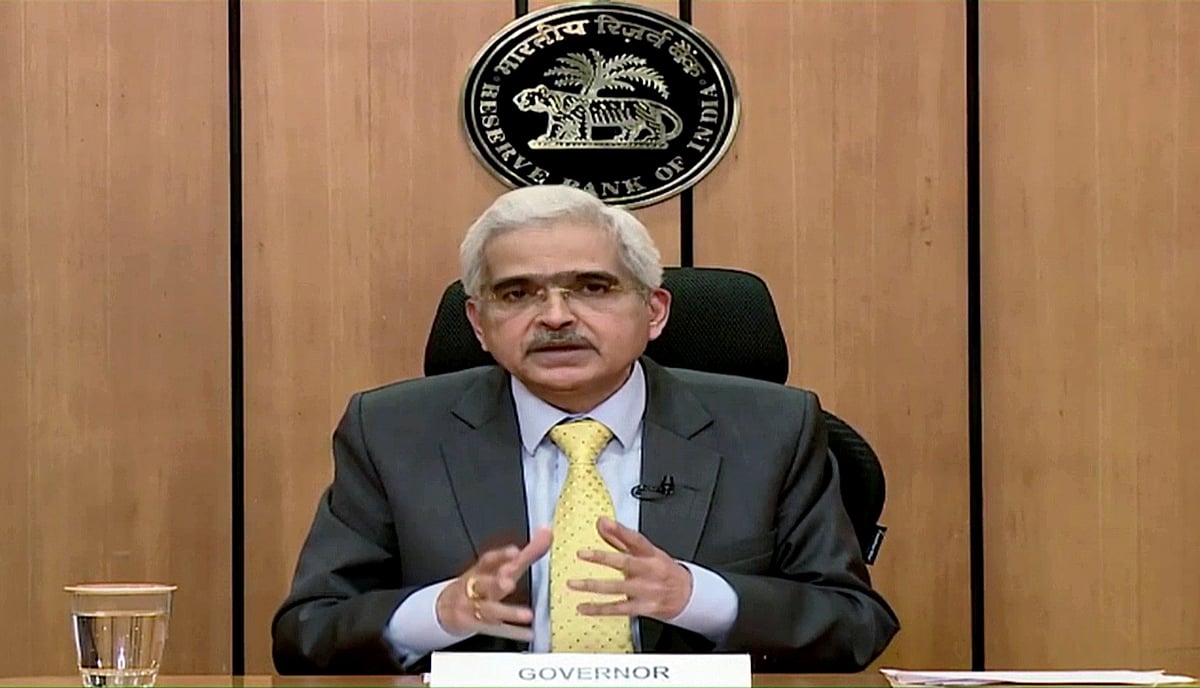

Since the policy rate cuts began in February 2019 that got accelerated after the onset of the pandemic, both new as well as old borrowers have benefited from the monetary policy transmission to the tune of 217 bps and 170 bps respectively, Reserve Bank Governor Shaktikanta Das said on Friday.

Policy transmission is the central bank terminology for banks passing on the benefits of rate cuts by lowering their lending and deposit rates for both new and old borrowers, which, however, is still titled in favour of new borrowers.

Between February 2019, which was Das' first policy announcement when he cut the repo rate by a modest 25 basis points (bps) to 6.25 per cent, and July 2021, the central bank has slashed the key policy interest rate or repo rate by a full 250 bps to 4 per cent, Das told reporters at the customary post-policy presser.

His predecessor Urjit Patel had left the interest rate at 6.5 per cent in the December 2018 policy after he began rate hikes early into his days in the RBI.

Das began the rate cut cycle in February 2019. On May 22, 2020, at an unscheduled announcement, the RBI slashed the repo rate by 40 bps to help shore up the economy amid the COVID-19 crisis.

Das had earlier reduced the rate by a hefty 75 bps on March 27, 2020 at the first monetary policy meet since the onset of the pandemic.

The governor said the RBI has been closely monitoring the pace of policy transmission, especially since October 2019 when it mandated all banks to set an external benchmark for their fund cost and loan pricing.

Between February 2019 and July 2021, both the new and existing borrowers have seen their interest cost come down by 217 bps and 170 bps respectively, while the RBI has lowered the repo rate by 250 bps, he said, adding there has been tangible transmission of rate cuts.

However, the governor quickly added that existing borrowers do not get the full benefits that new borrowers receive because of the reset clause in their loan agreements.

Das further said during the pandemic period between March 2020 and July 2021, the transmission for new loans has been 146 bps, while the same for the existing loans was 101 bps.

So there has been transmission, he underlined, and pointed out that even for many existing home loan borrowers, the rates are at historic lows.

Since the external benchmarking has been introduced, the transmission has been good for both new and old loans, as since October 2019, the rates for new loans are down 177 bps, and the same for old loans have reduced by 119 bps, Das said.

Under the external benchmarking of lending rates, banks can choose between the repo rate, the yield on three-month or six-month treasury bills, or any other benchmark rate published by the Financial Benchmarks India Ltd for linking floating rate loans.

According to RBI, as of October 1, 2019, of the 62 banks from whom information was collected, 36 adopted the policy repo rate as the external benchmark.

Successive governors, beginning with D Subbarao, have been focusing on better rate transmission so that the entire loan and deposit pricing becomes more transparent.

While Subbarao forced the bank rate on lenders, still the loan pricing remained opaque and this led his successor Raghuram Rajan to introduce the base rate concept -- which mandated banks to declare their lending rates on their websites and not lend lower than the disclosed rate.

As this too did not lead to the desired results, his successor Urjit Patel mandated lending rates to be decided based on the cost of funds.

Yet old borrowers did not benefit much from it, forcing the RBI under Das to enforce the external benchmark-based loan pricing.